Sim Trading vs Live Trading – Emotions Aren’t the Same

I’ve been trading futures for 8+ years at this point. I spent a lot of time building my own community and reading what others say in different communities. At some point I realized people say the same things with no rhyme or reason. It’s just parroted from one generation to the next.

For example, when I decided to commit to trading, I worked dinner shifts in fine dining. A common thing people would say when their plates were licked clean was: “Oh it was terrible” – Obviously this is a joke. But time and time again, and from one restaurant to the next. Humans seem to have patterns.

One thing I always hear from traders – is the emotions trading live is not the same.

Often times they explain how they trade bad and gamble up on sim. They need to trade live money and feel the heightened emotions of really being on the line to trade better. At least that’s what they claim. Even when they train on sim for some time they say that it still feels different.

Let’s pivot into emotions.

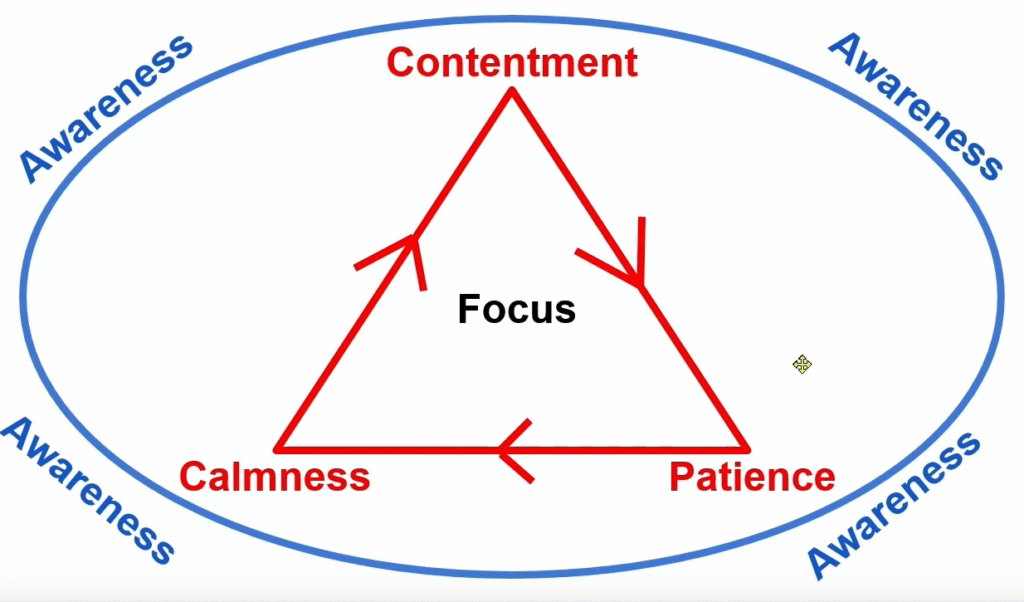

There are 3 ideal emotions to succeed in trading:

1- Patience

2- Calmness

3- Contentment

Let’s look into the opposite emotions of these three:

1- Impulsiveness

2- Tilt/Anger

3- Uneasiness

Most traders are familiar with impulsiveness, aka FOMO and Tilt. I’ve dealt with thousands of traders and within that group I’ve dealt with hundreds on a day to day. Never have I ever seen a trader that did not suffer from these negative emotions I shared. Every single one does at some point, and they always let these emotions get in the way. They know exactly how to trade, but for some reason they have a melt down and don’t know how to stop it.

I’m sure there’s someone out there that may not suffer from these issues – but I’ve never seen it. So odds are, you’re not that person.

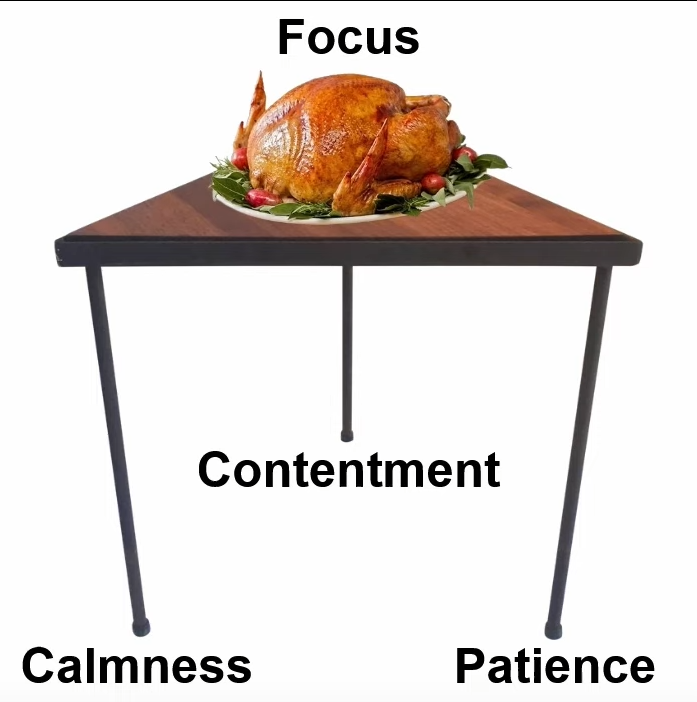

Pretend there’s a 3 legged table and each leg is one of the ideal emotions

Notice there’s a Turkey on it. This turkey represents your focus.

If one of these table legs collapses the turkey will fall off the table.

For example: You may suffer from lack of patience. After all, modern society is filled with YouTube shorts and tik toks, which means the focus of people are going down a lot. Higher performing youtube videos require a lot of editing of different angles and pictures to maintain user retention. Trading often requires you to do nothing for sometimes hours. But you have to focus. So typically traders get that itch. The itch they need to fulfill. Because they’re bored. Putting on a trade can relieve that boredom temporarily but often times is a bad trade in hindsight.

When they do this, their patience turned into the opposite emotion. Impulsiveness.

Lets pretend that these 3 table legs fold up like the landing gear on a plane. Or those folding tables.

Okay so imagine that the Patience leg is folding in. It didn’t completely collapse. Now the Turkey is starting to slide off which again is focus.

Heightened Negative Emotions During a Loss

Let’s pivot again.

Humans experience heightened negative emotions 2- 3 times more during a loss than a win. Why?

Here are a few reasons:

Reference points: Our brain tends to evaluate outcomes relative to a mental baseline or expectation. When something drops below that baseline (a loss), it’s more psychologically disruptive than a gain moving us above it.

Evolutionary survival: In our ancestral environment, losses (like losing food, shelter, or social status) could have serious, even fatal, consequences. Avoiding losses was often more critical for survival than gaining extra resources.

Risk management: From a biological standpoint, humans are wired to be risk-averse. Pain and negative experiences stick with us more because they act as warnings. It’s a way of making sure we remember what hurt us, so we can avoid it in the future.

Emotional impact: Loss triggers stronger emotional and physiological responses (like stress hormones) than gains do. That’s why we dwell on bad news or mistakes more than good ones.

Pivot once again to that table where you took an impulsive trade. Lets say it won. You are now reinforcing a bad habit as you’ve been rewarded for it with a win.

Your focus is waning and the table is leaning and then there’s another impulsive trade but this time you lose. It hurts and now you’re red on the PNL. You are no longer content with waiting for the right trade. You are no longer content with having a red PNL.

The contentment table leg is morphing into uneasiness. Now you have the Patience table leg folding in as well as the contentment table leg. The focus slides further to the edge.

You are now losing focus to take good trades and letting bad emotions cloud your ability to – well shit – be patient and content….

You take another impulsive trade – a revenge trade – because you are not content with being down, and you need to fix it because humans are wired to feel the sting of a loss 2 – 3 times more than a win.

Another loss. Now you’re pissed. All the legs collapse in and you go full monkey mode just trading like an idiot with no self control. The focus spilled all over the floor. You’re no longer having blood flowing to the prefrontal cortex which is the front part of your brain.

This is the executive control center. It handles attention, decision-making, impulse control, and working memory. When you’re deeply focused, especially on goal-directed tasks, blood flow increases here.

Now it’s gone. Literally not having enough blood in that part of the brain throws impulse control out the window.

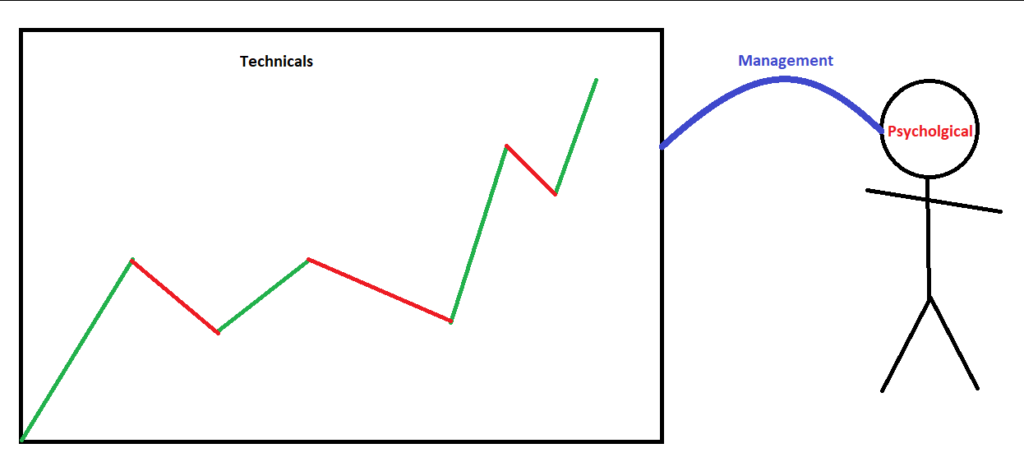

Emotions First – Edge Later

Here’s the real problem. Traders never – and I mean 95% of them NEVER work on ideal emotions.

New traders must learn trading psychology from the very start. Why?

Another common thing I see in the Trading sphere is – “Focus on edge first then psychology” or “New traders don’t need to know psychology only later”

Right now I’m face palming myself. How can you find edge if your brain is clouded with emotions and you can’t focus because there’s no blood in the prefrontal cortex??

Oh back testing, that’s right… No that’s not right! You know why?

You’re leaving yourself out of the equation. I talk about it in this blog post here about Navigating Market Volatility.

You are clicking buttons, or coding an algo to click the buttons. You are part of the decision making process. Therefore, when things don’t go right almost every fucking trader I’ve ever dealt with gets in their own way. Because they are part of the edge! Your psychology is very much edge.

Markets run on greed and fear right? Well, the algos know this and in today’s regime it fucks both sides. Price action over the years have become more and more predatory, feasting on traders emotions. It doesn’t care what side the bears or bulls are on for the most part. Sure, the market might be going down because of trade wars, but the pull backs to the upside can be painful enough and go long enough to further puke out the shorts.

Bears are not on the same team. The one who sold the highest, needs other shorts to push it further down to get out and the shorts near the low of the move can get screwed. Or the shorts who think they’re sitting pretty will have a massive pull back later in the day and stop all of them, but then the price dumps in filling a different group of bears.

What does all this have to do with sim vs live trading?

Remember when I said:

“Here’s the real problem. Traders never – and I mean 95% of them NEVER work on ideal emotions.”

Let me ask you this. What do you do when your tilted? Probably nothing. You probably don’t even record your trades, and if you do – you probably don’t cultivate ideal emotions in the review process. You probably don’t meditate, or have any idea of how hypnosis sessions, or visualizations can help fix your problems.

It’s called mindfulness techniques and most traders do not cultivate this. therefore most traders fail.

So when you say “Oh I need to feel the pain of losing real money to trade correctly” you are setting yourself up for disastrous results.

Here’s why:

When you’re brand new to trading you don’t know shit. All the information you consume is so contradicting from the other information you consume and there’s no crystal clear A-Z how to trade program. And if there is, it’s missing shit. Like what I’ve been telling you and what I will further tell you.

Then 3 guys on Reddit tell you – you need to trade live to feel the emotions and you go do it and it didn’t work. Now you feel like shit because you blew $600 in a day.

As a new trader, every time you place a trade you are associating that with a specific emotion. Most likely the bad ones I mentioned earlier:

1- Impulsiveness

2- Tilt/Anger

3- Uneasiness

A lot of new traders can’t handle 2 losses in a row, but in professional trading it will happen. So the moment that happens to the noob – they feel uneasiness.

They never cultivate the ideal emotion: Contentment.

After a year of tilt and FOMO trading, they’ve now trained their subconscious mind to react to 2 losses in a row with lack of contentment and tilt. Or a spike up or down in price action with impulsiveness. If they don’t trade for 10 minutes they feel the need to, and take a loss. Then the heightened pain of 2-3 times more on a loss than a win, compounds. It’s like the trader behaves and boom – they unravel pulling down all the progress they made.

Every piece of price action triggers certain emotions.

Every PNL swing trigger emotions.

The average trader is completely oblivious and unaware. At some point they start to realize they’re the problem, but usually that’s deeper into their trading journey after they’ve unintentionally conditioned the subconscious mind to react emotionally.

Trading requires the ability to rewire the brain. The way humans have evolved – they are risk adverse. The brain from the evolutionary perspective was not designed to handle the rigors of trading. Therefore you must learn to reprogram your brain.

I remember how I would be fighting the market and pick up 1 tick wins and once I’d be 5 trades in I’d get frustrated I could never get the trades to work. My contentment would crash down, I’d lose my patience and push trades forcing bigger wins. Problem is they would blow me out. When had I stuck to fighting from an ideal emotional state, I’d have a good session. Sometimes you just have to fight.

Properly Tracking Your Emotions

The reason I’m sharing this is FOMO and tilt are not universal. It’s very nuanced. Just like price action patterns.

1- My tilt maybe 5 one tick wins.

2- I may even experience tilt when I take 3 losses in a row.

3- Then I could experience tilt if a big trade went without me.

While tilt may seem universal. Each one of those 3 scenarios are unique and nuanced. These scenarios are triggers. Therefore I have to train the mind for each one of those scenarios.

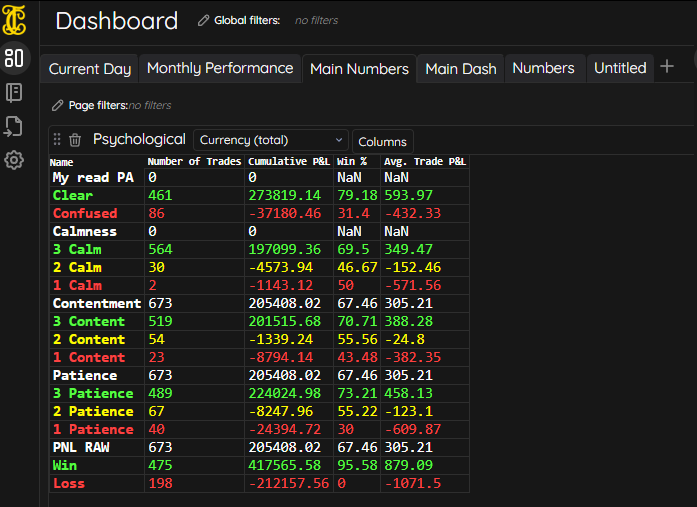

The way this is done is through the review process. You should be tagging your trades. The Trade Craft trading journal is by far the most capable one out there.

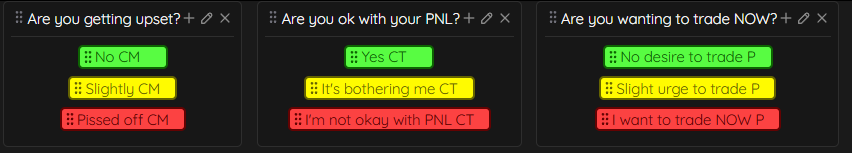

Below are tags I use to track emotions:

All 3 groups are tied to calmness. Which are the tags with CM at the end; Contentment which is tied to the CT tags. Finally Patience – which are the tags that have a P at the end of them.

The colors go from ideal emotions to not ideal, which is:

Ideal emotions:

1- Patience

2- Calmness

3- Contentment

Not-ideal emotions:

1- Impulsiveness

2- Tilt/Anger

3- Uneasiness

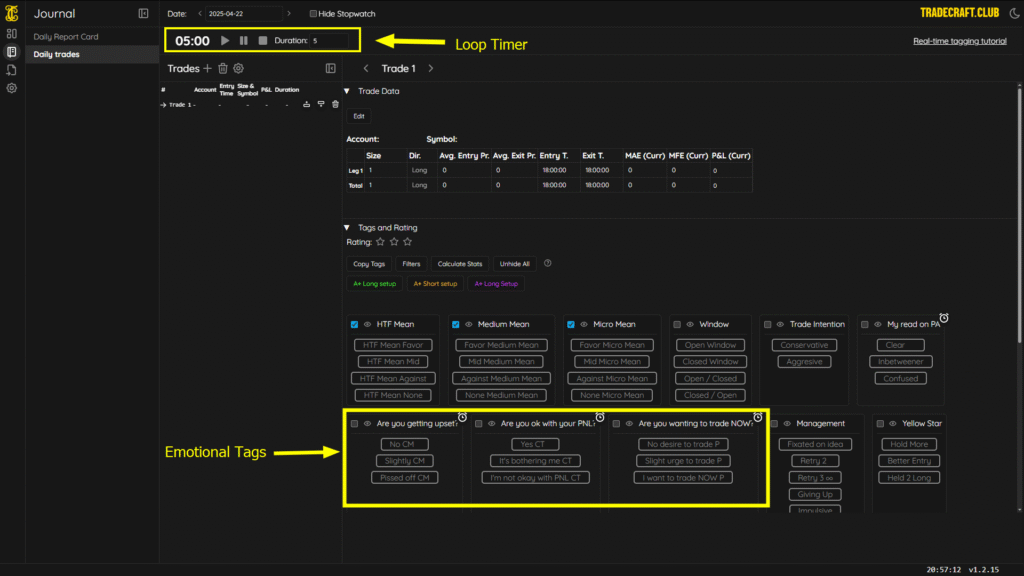

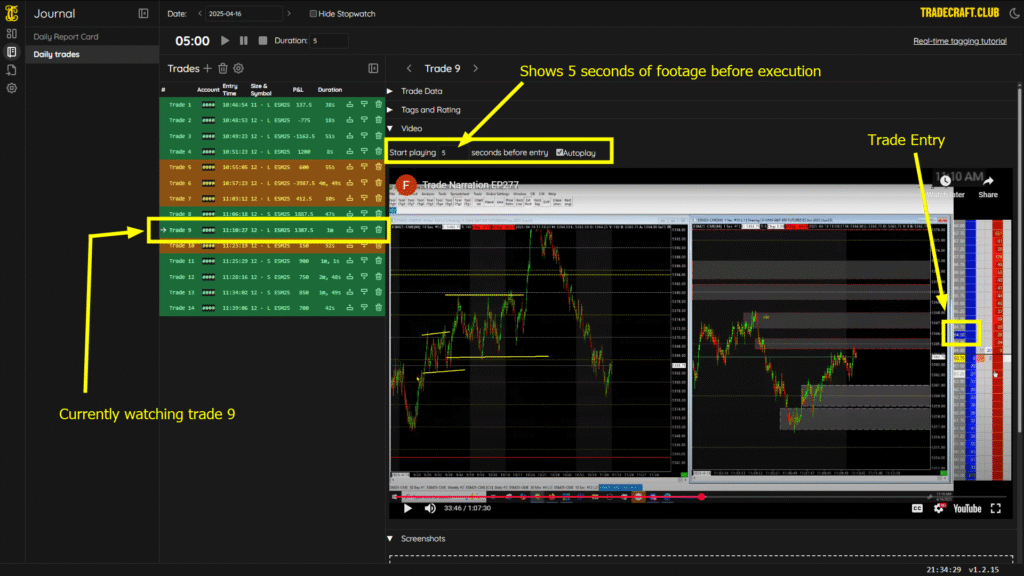

The first group asks: Are I’m getting upset? I like these groups being in a question format. The reason is, I use the built in loop timer on the Trade Craft trade journal.

Here is a picture below:

I run a loop timer that beeps every 5 minutes to check in with my emotions. One can’t simply know what their emotions were when they review hours later, during the heat of the moment. Therefore, it’s important to tag your emotions live as you trade in your trading journal.

Mine are setup in question format. So I read “Are you getting upset?”

Reading it in a question format where the question is directed toward me – makes me really evaluate my emotions.

Notice the answers.

–No is green. Green is associated with good to go like a traffic light. So there’s a subconscious play to help my mind with the color, because I’ve been driving for almost 3 decades now and go when the light is green.

–Yellow means slow down on a traffic light so we see that I’m slightly upset which is a warning to stop.

-Finally it goes to red which is bad. That means stop, and it says I’m pissed off.

Tagging live and flicking from green to yellow on all three of these every 5 minutes and when I take the trade creates awareness.

Remember – I said earlier most traders aren’t aware they’re starting to go off the rails emotionally. This helps build awareness.

Also tagging is super fast and incredibly easy in the Trade Craft trade journal. All you do is just click the tag.

Above is the 3 ideal emotions. They each feed into each other. Typically when one goes to hell another one follows. Then the focus goes. Which physically means the blood is flowing away from the prefrontal cortex.

You must be aware of each of the 3 emotions at all times. It’s a skill set to cultivate this awareness and trade tagging in the Trade Craft trade journal is one way to build awareness. With a loop timer you are building awareness in the moment. Not at the end of the day, but right then in there and hopefully you can take action.

Now one can’t just take action. You’re going to get triggered.

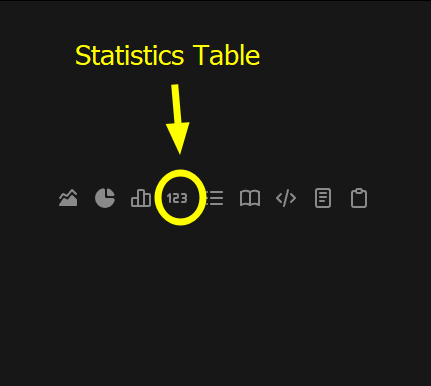

One way to realize how bad emotions are hurting you, is to take those tags on the Trade Craft trade journal and go into the dashboard. You want to look at the statistics table widget here:

Then you can build filters with your tags like this:

You can see a lack of patience out all 3 of the big emotions is the one hurting me the most. There’s been a total of 673 trades in my journal. 489 were pure patience. 67 were when impulsive trading started to creep in. Finally, 40 trades where pure impulsiveness. This cost me over 24K in loss…

There are things that are fully in your control with trading. Emotional control is one of those things.

However as I stated earlier – humans are not wired to do this. They must rewire their brains. This is a skill set that has nothing to do with trading, but everything to do with trading. When you rewire the subconscious mind to endure the stress of trading, it changes you as a person. Your life outside of trading becomes more peaceful. The guy that cut you off in traffic doesn’t piss you off. Because traffic is like trading. You’re not in control of what other people are doing.

The way one fixes these issues is through mindfulness techniques.

Visualizations are a big one.

I always recommend you video record your sessions. When you watch yourself trading it often times can re-trigger those bad emotions. This is good.

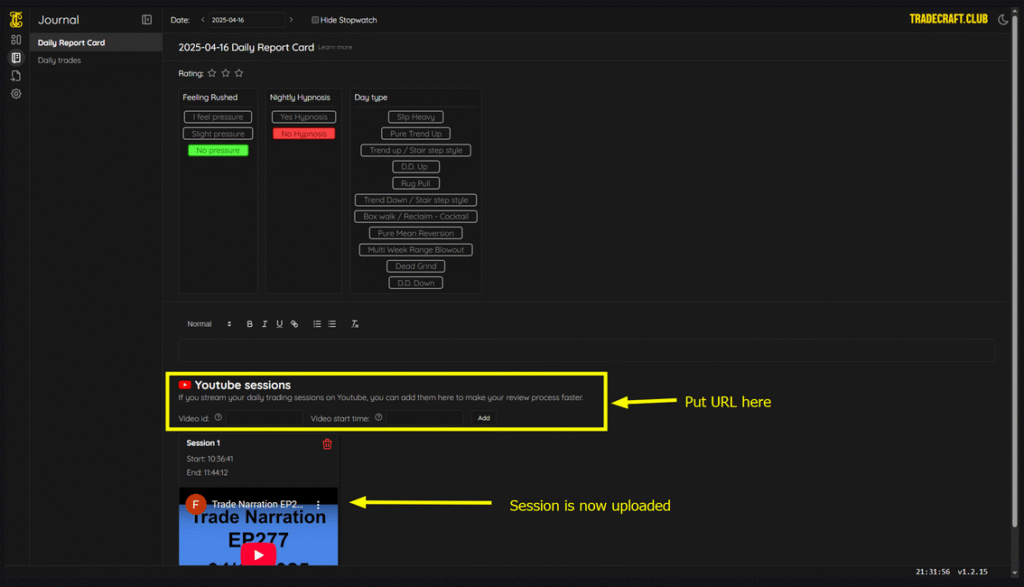

With Trade Craft you can record your sessions to YouTube – which is a great place to store video files. You take the URL and enter it into the Trade Craft Daily Report Card section.

Then Trade Craft Trade Journal automatically syncs every trade in the journal. So when you go watch the video on each trade, it will show the entry without you needing to pan through a video file that’s hours long. You can also have trade craft show price action several seconds before the trade is put on. It’s completely customizable.

What I’m about to share is labor intensive and if you can’t short cut some of this process you wont do it.

When you watch the recording of a trade that triggered you. Hopefully you start to feel it again. There’s nothing like a recording of you placing the trade to make you relive that moment. You can’t feel the emotions looking at a chart with your entry and exits like an actual video recording.

Lets look at a trade where you FOMO the entry. You want to get calm. There are multiple methods so you must find what works for you.

Meditations & Breathing: Improving Your Trading Performance

Reduced Activity in the Default Mode Network (DMN):

- The DMN is active when your mind is wandering — worrying about the past, future, or random stuff.

- Meditation, especially mindfulness practices, quiets this network, which is associated with rumination and anxiety.

Changes in the Amygdala:

- The amygdala is your brain’s fear and stress center.

- Studies (like those using fMRI) show that regular meditation can shrink the size and reactivity of the amygdala, lowering your stress response.

Boosted Prefrontal Cortex Function:

- Meditation strengthens connections here, helping you respond to stress more calmly and thoughtfully.

- This area handles executive functions like decision-making, focus, and emotional regulation.

We can see how meditation really helps us in many ways from a scientific stand point. Personally for me I become calm in almost a narcotic way, when doing a meditation. Now meditations can be tough to pull off when you’re already upset. The mind wanders pretty bad and I tend to have a tough time just locking in.

The next technique is Whim Hoff

This is a breathing excessive where you almost hyper ventilate with violent breathing. It’s a quicker process than meditations. Here’s what happens:

-Oxygen drops slowly, CO₂ builds → triggers parasympathetic rebound

-Heart rate lowers, calmness increases

-Deep relaxation response afterward

–Alpha and theta brainwaves increase (associated with calm, meditative, and creative states)

Basically you’re forcing a meditative state by shifting the brain waves and putting yourself into a calm state.

Finally we have a third eye technique.

This technique is used in some therapies and yoga practices. You look up focusing on one spot while keeping the head straight. It’s almost like you’re attempting to look at the middle of your forehead. You start breathing through the mouth and out through the nose. Deep breaths slowing it down. I’ll use a combination of this technique and the Whim Hoff breath.

Once calm, you now need to watch the FOMO trade from a place of calm. If you needed to not trade that price action – It was impulsive – Then imagine yourself being calm, content, and patient. Repeating to yourself over and over how you’re not phased by this move up on the recording. Visualizing yourself making the right trading decision in that moment by doing nothing.

If the recording is triggering you, do a mindful technique as shared above. Get calm again. Detach from everything around you.

Watch the recording again from a place of calmness, contentment and patience. Visualizing as if you did not place a FOMO trade on that part of the recording.

You keep doing this until you are complete at ease. BE HONEST WITH YOUR EMOTIONS!

If you needed to hold a trade longer or enter elsewhere – Visualize yourself doing it on the recording from a place of calmness, contentment, and patience.

This is a hybrid technique of watching something while tapping into your imagination and pretending you are doing something different at the same time.

Why visualize?

I’ve yet to cover this: Imagine a time when you were so stressed out that something negative was going to happen. You spent hours or even days stressing about it. Later that thing you were stressed about didn’t happen and you stressed over nothing.

You felt a negative emotion over nothing. An emotion that felt so real, it stressed you out to the point you were sure something bad was going to happen.

Modern humans are really good at this. What they’re not good at is doing the opposite of it.

Feeling so good about something that didn’t happen.

It’s no secret stress is bad for humans. What’s important about feeling good all the time is you are more likely to have the mindset for success. You are more focused as the blood flows to the pre-frontal cortex, whereas stress takes the blood away.

When you stress you’re most likely visualizing the stressful situation. In fact you visualize all the time.

It’s been scientifically proven through multiple studies how visualizing can help medical patients and athletes.

I was asked by another trader to elaborate more on this once. They didn’t believe visualizations could work. All you have to do is look at placebos in medical trials. Those work and more of us know that.

During World War II, Henry Beecher, a surgeon, ran out of morphine while treating wounded soldiers. He then used a saline solution, telling the soldiers it was morphine, which led him to discover the placebo effect. A significant portion of the soldiers reported pain relief from the saline solution, demonstrating the power of the mind-body connection.

Reviewing your triggering trades from the ideal state of calmness allows you to associate that state to that type of price action or PNL. Therefore instead of associating price action patterns and PNL swings with tilt and FOMO – you are now enforcing the ideal emotions of calmness, contentment, and patience.

Patterns in trading create patterns in your emotions. You must be aware and enforce the ideal emotions.

This is why when traders say live trading feels more emotional than sim and they need that. They’re setting themselves up for disaster.

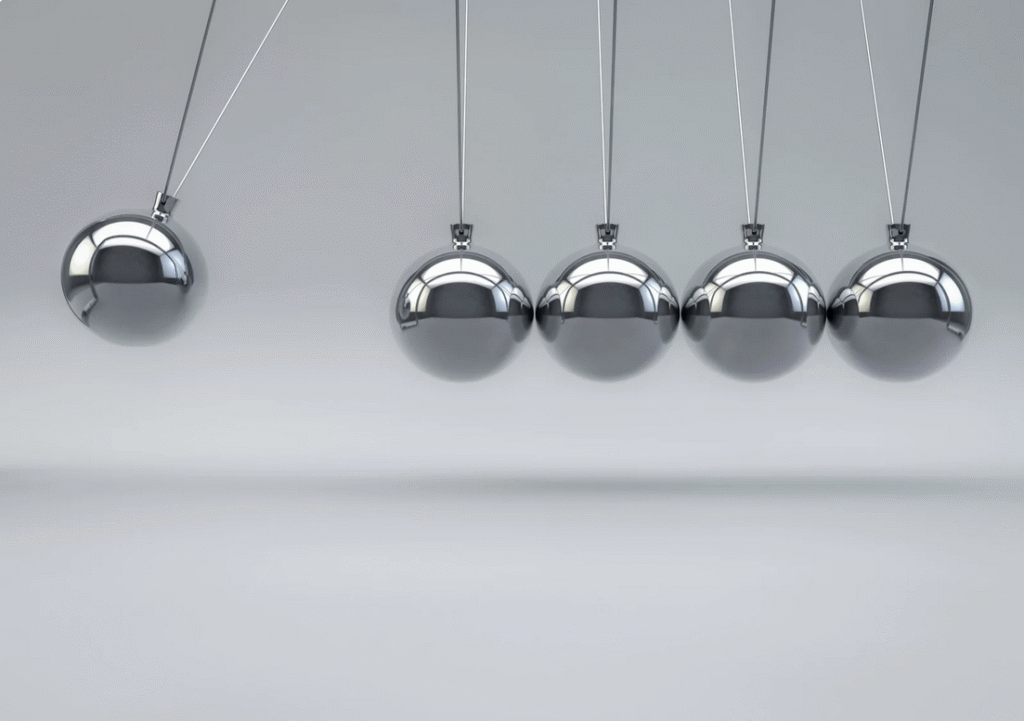

These trader’s emotions are like a pendulum. When they get a win – it’s a hit of dopamine and they feel sooo good. The emotion of feeling ecstatic can often be bad. You want to ideally be in a calm state or place of being focused. This focus and calmness is like the pendulum not moving. It’s almost as if it’s in the middle. When you pick it up and pull the pendulum from one extreme and let it go it will swing to the other extreme which is tilt or anger.

Anytime I see a trader say they need to feel the emotions of live trading, that’s a sign they have erratic emotional swings. You should ideally be as calm and centered as possible even when you hit it big.

Transition to live should not be this jarring thing where you are jumping into a freezing body of water. You should be able to transition smoothly.

Pilots and astronauts train so much on sim – drilling worst case scenarios – maintaining their calmness – that way when they get into the real thing, they’re able to transition smoothly.

If you flew a commercial jet, after just a month in the sim, and never drilled when things went wrong, you’d freak out. Most likely crash and burn. Same thing with a live account.

You should be so confident on sim in your trading ability and psychological ability the transition should be smooth. If you’re not treating sim seriously which a lot claim they never could. Then that means they have impulsive issues. They lack patience. They want to rush the process, and trading will punish you for rushing the process.

Unfortunately these traders never read this blog post, and are unaware of what trading really is, let alone their own emotions.

You really can’t find everything on the internet and if you do it’s so fractured – it’s like dumping out a jigsaw puzzle with 10,000 pieces. You have to put it together one piece at a time. You’ll end up sifting for a long time just to find the first two pieces that fit.

Keep in mind, the Trade Craft trade journal allows you to do all these processes faster and more streamlined. Even though it’s still a lot of work. After all, I’m the founder, and have designed the journal based off these mythologies I’ve shared.

I hope you enjoyed the post. Be sure to share this with other traders so they can be more educated in the realm of trading psychology.