Prop Diaries EP6 – VIX 50

I’ve been spending a lot of time in the sub reddit r/Daytrading, and I saw a lot of guys getting murdered in the elevated VIX. I talked a lot about high volatility in this blog post.

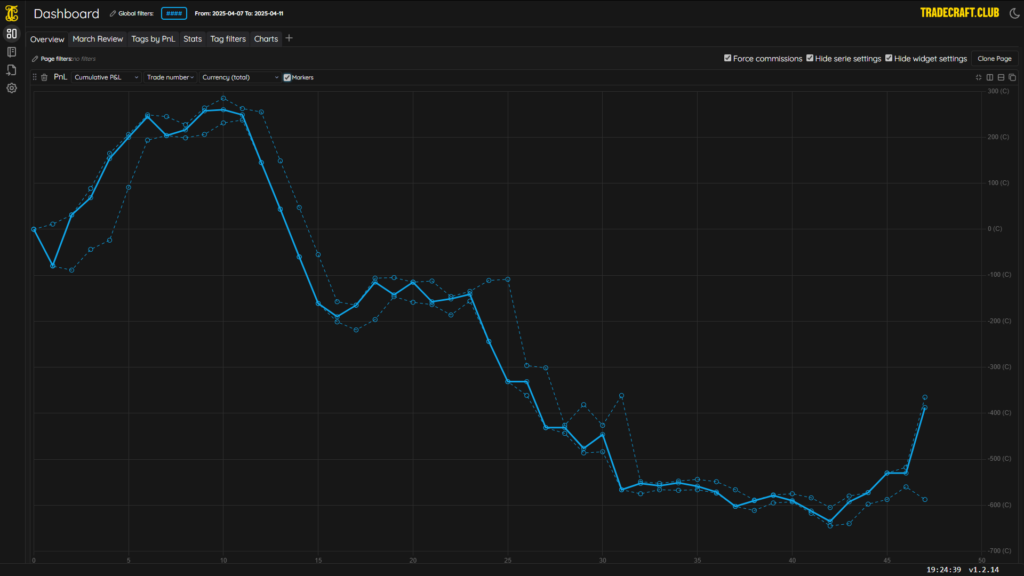

Chronik, my prop trader has not traded VIX 50 in his short futures career. So naturally, how can someone be good at something they never experienced? Here’s his PNL form his trade journal from this prior week:

He obviously struggled. VIX went up high because of the Trump trade wars. I had him size way down to 1 micro, because I needed him to have 20 point stops. Again, my blog on volatility touches on how to manage elevated VIX. I sized down myself and took on more risk. Unfortunately for Chronik, he can’t take on more risk since he’s on a combine. I needed him to size down to where he could get 5 tries – or 5 stop outs – on 20 point wide stops.

We can see Monday started off well, but then Tuesday came around and things got sticky with back to back blow outs. I know Chronik struggles with contentment. Which we did do a new Hypnosis the following Monday to address this. What we noticed is the Hypnosis sessions have fixed 2 problems: One being his sensitivity to price spikes and the other is the urge to get into those.

Fake Out Price Action

Wednesday had changed when it came to price action regime. We had been getting clean patterns that worked in the price action, but Wednesday – Friday turned into fake out patterns.

See we shifted our approach to pick up a minimum of 5 points in VIX 50 and it was working. We needed to offset the bigger stops we were risking with bigger wins. However, as the week went on that was no longer a viable strategy. Turns out 1 – 2 point scalps is where we needed to be. Fake out price action is certainly a tricky type of environment to trade. Basically, the price action is really good at fucking both sides – the longs and shorts – out of their positions. It’s almost like this predatory price action. It feels like one entity is control.

I had been telling Chronik we haven’t seen fake out price action in a while. I kept telling him over and over because I knew it was coming and it did. I even struggled to shift gears. I took a nasty down day on Friday myself. Here’s my weekly PNL on my trading journal:

I made so many critical errors. I got married to a trade idea and stopped scalping. Interesting thing is Chronik rolled in when I was mid-session Friday and took my trading advice and scalped his way out of some his weekly draw down. He did what I told him, while I ignored my own advice.

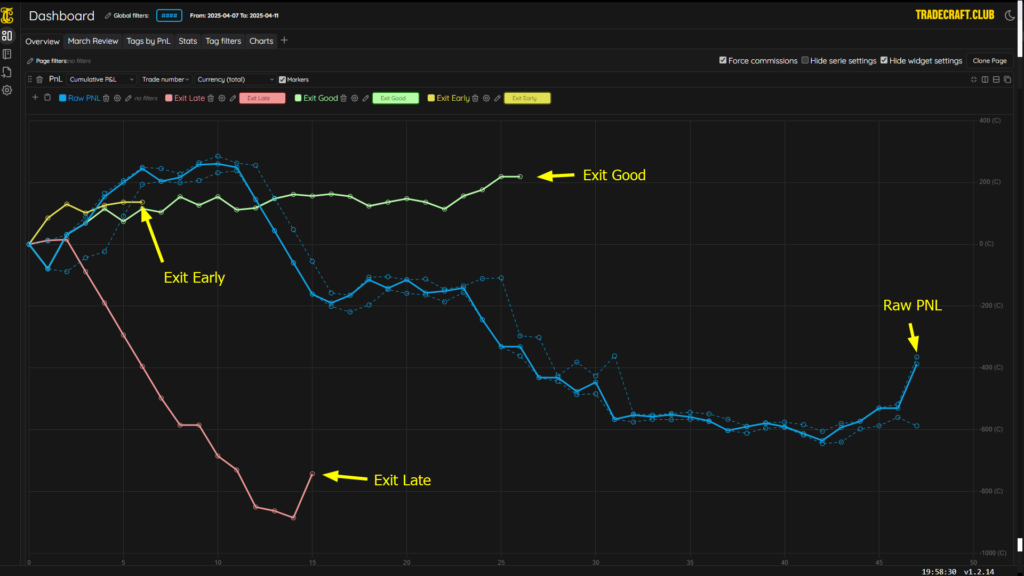

Part of Chroniks problem as I stated earlier – we needed to go from 5 point minimum scalps down to 1 – 2 point scalps. Here’s a screen shot on his exit tags from the Trade Craft trade journal:

We can see how he just held trades right into his stops. No cutting. Like his brain turned off once the trade was on.

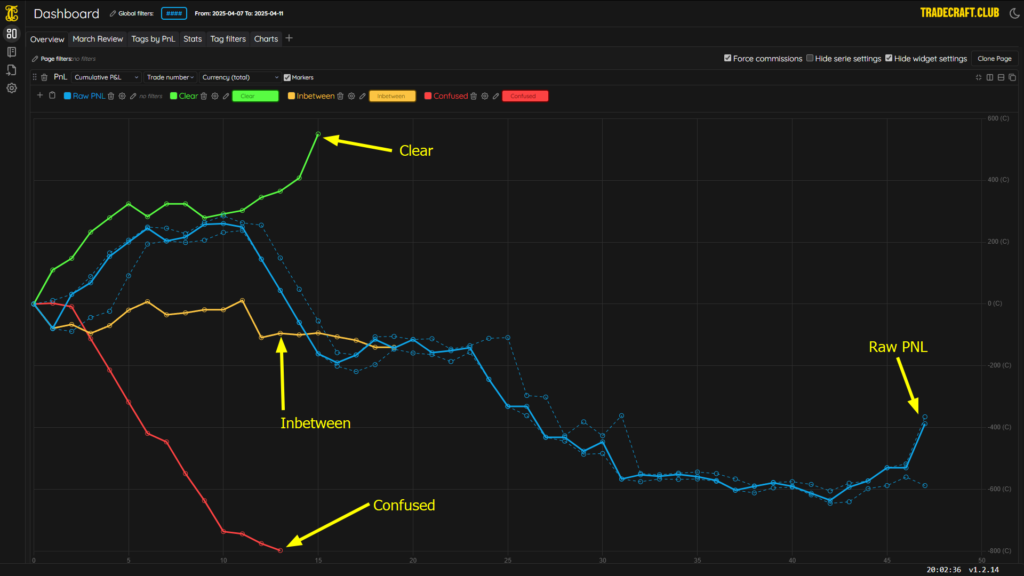

Now, lets go into the part of his Trade Craft trading journal where we see his clarity on trades:

I wrote a blog on clarity you can find here.

Clarity in trading is so fucking important. I can’t express this tag as a crucial tag to have in your trade journal. We can see how he took too many confused trades. As I write this, I’ll have him build out a histogram on these 3 tags where he internalizes it daily. His goal should not to be to make money, but curb the confusion. Which we updated his hypnosis track to address.

I had another trader named Yuki explain how identifying clarity and confusion in trading is a skill set. This is why I like meditation. It’s a skill set to catch the mind when it wanders off and bring it back to focus. It’s a teaching tool that can aid traders in self awareness. Chronik is still a student in understanding this and mastering it. I don’t expect perfection. I am however proud he survived VIX 50 without blowing his account unlike so many others.

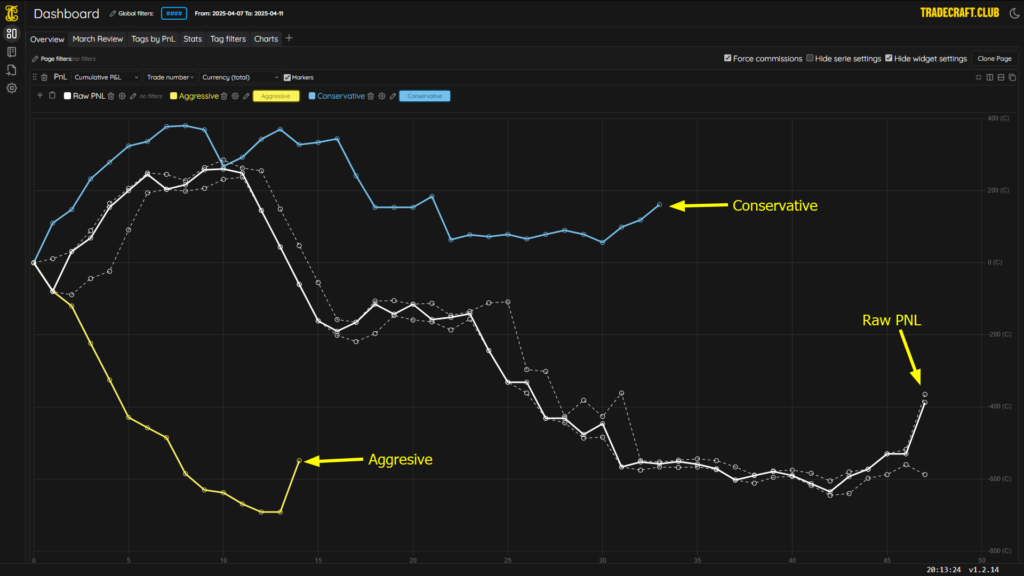

Finally, we will look at Chronik’s aggressive trading vs. conservative trading. Lets look at his trading journal again:

I’ve addressed this very statistic in a prior blog post here.

Conservative trading works for Chronik. We can see even though he would have struggled, but for the week he would have been up, vs aggressive trading. Aggressive trading is killing him and is why his account is sideways. We are addressing this in his hypnosis, as well as pre-market visualizations.

Hell – aggressive trading doesn’t hurt me like Chronik, but after 637 trades entered into my trade journal, you can see how smooth the conservative equity curve is compared to the jagged whippy equity curve in associated with my aggressive tag:

With all that data being shown in from the Trade Craft software – we can see how one must pivot to get better. After all, if you don’t track these things you’ll just guess and flounder for years. That’s why I’m doing this prop diaries series; I want to show to you guys just how powerful trade tagging and reviewing can be, by getting a trader consistently profitable. Our trade journal is only going to get more powerful as we are constantly taking it to the next level. Plus, as the founder, it’s being developed by traders, not coders who trade for a hobby.

Getting it Out of Your Head

Now, stats aren’t good enough. Good old fashion pen to paper or keyboard to note in this case is still crucial for one’s development. There’s something therapeutic in writing things down and just getting it all out of your head. Below is Chroniks own words on the week. Now keep in mind he still hadn’t traded Friday when writing this. However after writing it, he crushed it.

- Weekly Review April 7th-11th Rough week. Honestly the worst week I’ve had in many many months. Account is at fresh lows after Thursday. But I figured it was a great week to share with everyone. There were volatile highs and lows in price action, PnL and emotions. While this week is kinda devastating to look at on paper, I still feel a huge sense of accomplishment in having traded through it and survived to tell the story. It’s very hard to maintain this positive mindset but it’s also impossible to ignore how great a learning opportunity this was.(edited)

- [11:32 AM]Monday +$150.55 We all remember Monday. Holy fucking volatility. It was terrifying in a lot of ways but I carried with me a confidence I’ve never had in an unknown environment. This was direct result of team trading. Through REVIEW and DRILLS I was able to hit the ground running on Monday. That doesn’t mean it was easy! I stumble fucked my way to +$150 and clearly the days following are evidence I’m still learning. But had it not been for the drills and the review sessions the week prior I would have went right to DLL. No question Because it was only through our extensive review last week that we came to the conclusion that I need to size down. This may seem obvious to some of you. But there’s a difference between saying these things and understanding them. FC could just tell me to size down and I would, but I would never really understand why. I NEED shit to make sense to me. It’s part of my MO. Just being told what to do isn’t good enough. I’m not going to stick to that rule and it’ll eventually piss me off because I don’t understand it for myself. And guess what? The best way to learn those lessons is by making mistakes. But YOU WILL NEVER LEARN FROM THOSE MISTAKES IF YOU DON’T REVIEW! It’s starting to make sense, right?

1

- [11:33 AM]Wednesday -$323.80 Well Tuesday I didn’t trade and Wednesday came around and slapped me silly. It was a fuckin struggle session. Up and down all morning. I eventually ran into contentment issues. Remember how I had sized down the week prior? Well now the trades that I had been pushing for multi point moves were coming back on me. Fakeout territory. We were trading a few hours before FOMC where price ALWAYS chops. What wins I could grab were 8-10 tick scalps, but at one micro, it would take 20 winning trades to hit profit target. But when a trade went against me, I took too much comfort in my 20 point stop and thought “there’s no way it’ll drop 20 points”. Well sure enough it did. And what’s worse, I tricked my mind into being comfortable with that loss. When the next winning trade came, I would try to push it for 20 points to negate the loss, only for it to come crashing back 20 points the opposite direction. I wasn’t effectively bankrolling. I wasn’t observing and adapting to the fakeout price action, which to be fair requires a lot of experience. And worst of all, I was ignoring worsening contentment issues. I wasn’t content with my PnL. I was frustrated with my performance and how deep a hole I had dug myself into. These issues would boil over the next day.

- [11:33 AM]Thursday -$424.20 Thursday was another struggle session. Three consecutive days of clawing desperately for winning trades. I had the day off work which allowed me to stay at the desk as long as I wanted. But I think this worked against me. I actually managed to pull off a decent morning session after drilling and meditating. Up around $100 and floundering. I had sized up to 2 lots and was seeing mild success scalping. But I yet again failed to grasp the concept of bankrolling, and that even when you’re up on the day you need to be rolling your PnL curve upward. Almost like a trailing DLL. The afternoon session saw a huge surge in volatility and it ate my ass like a buffet. 2 lots at 10 point stop was yet again too tight. What’s worse is that we were still in fakeout territory. Same price action but stretched. So I think dropping down to 1 lot wouldn’t have helped. My only option to trade that price action was scalping. But after giving back all my profits and suffering through contentment issues to the point of fatigue, there really wasn’t any hope. I think I should have walked away in the morning. It requires an insane amount of experience and discipline to trade that kind of price action. It’s not impossible, and the opportunities are insane, but for someone of my experience level it should be approached with much more caution that I was practicing at the time. I don’t plan on trading Friday. I think that, with my account this close to liquidation, I need to take a step back and reassess my approach. It hurts like hell to think about blowing this account. But I think that’s a good thing. In the past, blowing an account was usually associated with a feeling of relief. Like I just wanted the misery to be over and reset. This time is different. Even if I have to scalp one micro for the next three months I will preserve the account. I’m gonna have like 80/12 days traded but who gives a fuck.

- [11:34 AM]I think that’s a bigger accomplishment than resetting over and over until you pass on a lucky winning streak.

- [11:34 AM]Things I did well I survived the highest volatility since COVID. It’s really as simple as that. Granted, I dug myself a massive hole and I’m closer to liquidation than I’ve ever been. But I think that if it weren’t for the team trading with FC I would have blown my account multiple times by now. Not only has he saved me hundreds of dollars in reset fees, but he’s also forced me to keep an account alive longer than I ever have. After all this is how trading a live account works. You can’t just “reset” a live account. I also didn’t hit DLL at any point. Which doesn’t say much considering the drawdown I’m in but I think it’s testament to my improving emotions. At no point this week did I go on tilt, despite trading in the ideal tilt environment.

- [11:34 AM]Things I Need to Improve On Where do I even start. I think that the biggest problem this week was contentment. I find it very difficult to identify contentment issues and when I do it’s usually too late. I think I was aware of the issue this week but I did little to address it. I kinda let it bubble over without intervening. But how exactly do I address this issue? I think the answer primarily lies in risk. Last week, through extensive review, we came to the conclusion that I need to size down in high VIX. The problem is that the market isn’t as black and white as “high VIX vs. low VIX”. The character of the market takes many different forms day-to-day, and VIX just dictates how wide the moves are. There are moments in VIX 50 when the average rotation is like 100 fucking points. I need to have the widest possible stop while still allowing myself five losses before DLL. My only option is to trade one micro. This kind of environment usually offers loose moves and opportunity to catch 20-30 points. But there are also moments in VIX 50 where the average rotation is like 10 points, with areas of tightness. These areas are usually still extremely volatile and faking out constantly. You need to cut trades IMMEDIATELY. You can’t push those 20-30 point moves. But the hardest part is that it can still blow you out 20-30 points. Being wrong hurts. You need to be in and out as quick as possible. I learned this lesson on Thursday and I’m determined to find a solution.

- [11:35 AM]Changes I Need to Make My sizing needs to be fluid and discretionary. I hate that. I don’t want to change my size on a whim. It makes my head hurt. But unfortunately I do not have the freedom to keep one size and increase my $ risk amount. I’m trading an account with a strict DLL and trailing liquidation balance. I can’t afford to just increase my risk for increased reward. But there’s also a psychological aspect to it: contentment. If I’m, by default, trading one micro in VIX 50 I am not going to be content with scalping 8-10 ticks. I wish that wasn’t the case but I’m only human. And yesterday proved that sometimes that’s all you’re gonna get. If you get 8-10 ticks in a fakeout environment you bet your ass that thing is gonna come back on you for 10-20 points. I LOVE scalping. But fighting like hell for $10 profit while risking $100 does not make sense statistically.

- [11:35 AM]So I can’t look at VIX as a size guideline. I need to develop my own metrics for determining my size. No matter what, my stop needs to be $100 as to allow five stops before DLL. This means my size will be dictated by how many points I need to risk in an average rotation. 1 micro = 20 points 2 micros = 10 points 5 micros = 5 points (roughly) But it’s not quite that simple either. An average rotation could be 20 points but the market could be faking out and only offering 2 points. See the problem?

- [11:36 AM]I want to utilize my natural strengths. I think the idea of fluid sizing scares me because I’ve always traded one size and I’ve always tried to be systematic. But my MO is adaptability. My MO is constant change. I just need to focus. REALLY focus. I need to understand what the current average rotation is using the 5 point horizontal grid line as a measure or the chart calculator tool. I also need to have an idea what the current regime is. Are we slip ranging/respecting reclaims as was the case Wednesday? Do I have reclaim advantage and therefore tighter risk? Is there a clear invalidation level? How much can I risk before that invalidation level and what reward can I expect from it? Are they faking out? Do I need to posture defensively and cut near B/E or do I need to let trades breathe? You can see how complicated it can become. This will be like developing a new skill set. There will be pain and that’s why I think it’s important that I lower my overall expectations while I’m bankrolling out of this drawdown. But I also think that it will force me to focus on these things a lot more. It will make me a better trader as a result and give me more clarity.

- [11:36 AM]Which brings me to my next point: clarity. I’ve been getting a lot better at seeking clarity in recent weeks. But this week was sort of a relapse. I still didn’t have nearly as many confused trades as I have in the past but they were definitely there. Especially on Wednesday, where I took an impulsive trade in an area of immense confusion. I told FC where I went long and he said “why did you go long there??” I don’t really know. Sometimes I just fuckin click buttons. That impulsive trade was the beginning of a domino effect where I took 4 consecutive stops after being up on the day. See how easy it is to fuck a session? I need to make sure I’m executing with absolute clarity. The moment that clarity slips or I realize I was wrong about the clarity I need to cut the trade. Holding to B/E is fine and dandy when you have a reason to believe it’ll retrace to your entry. But if you’re instantly wrong about a trade you need to get the fuck out.

- [11:36 AM]Summary I’m disappointed. I was REALLY disappointed yesterday. But I can feel a wave of cautious optimism washing over me. This kind of is like a reset to me. I’m resetting my approach, but not my account. I know I am capable of doing this. I just need to slow down and size down. I need to return to scalping. The long ramble about sizing and contentment doesn’t really matter. I just need to return to the basics while paying more attention to the environment. I have a feeling those 100 point rotations are behind us for now and I can focus on scalping. But when those 100 point rotations come back I’ll know exactly what changes I need to make. You have to experience it to know what to do next time. I think my problem was that I generalized the VIX and ignored the price action nuances. Just because VIX is at 50 doesn’t mean I should be holding for 20 point moves. But I also can’t expect to scalp 8 ticks when the daily range is 500 points wide. Trading isn’t black and white. You need to constantly be adapting.

- [11:36 AM]Goals for Next Week

- Take no more than 3 consecutive stops in a day. I think if I’m getting slapped that many times in a row my approach is totally wrong and I’m entering revenge territory. It’s good to claw back but it’s also good to cut losses and reflect.

- Trade at least 80% scalps. I can verify this with TradeCraft at the end of the week. It’s okay to try holding occasionally but I know my strengths and I know I need more reps scalping.

- Trade at least 60% clarity. Again, I can verify this through TradeCraft. I think “inbetween” and “confused” made up way too many trades this week. I want to strive for absolute clarity. I even think 60% is too liberal but I will try and account for invetweener probing. I want this number to increase each week.

- Track profit in ticks, not $ amount. I’m not an idiot, I can do basic math to figure out my $ amount. I don’t expect this to fix any problems. But I think it might help my contentment issues if I see “+11T” on my screen instead of “+$13.75”, the latter giving me discontentment and necessity mindset to hit my $200 profit goal each day.

- [11:37 AM]I haven’t discussed a lot of this with FC so take it with a grain of salt. A lot of these observations and goals are my own. He may come in here and start calling me an idiot on some of this shit and I welcome it. I also welcome any of you to give me feedback, constructive or critical. I’m not a bitch and I can handle it. I’ll be trying to post more of these weekly reviews as I have more free time to write them all at once than I do DRC’s day-to-day. I think it’ll be a more realistic habit according to my schedule. Have a good weekend guys,