Prop Diaries EP1 – We Started A Prop Firm

Some of you may or may not know, but I’ve started a prop firm.

Not an “online prop firm” which most aren’t even prop because there is nothing proprietary you get. My idea of proprietary is getting access to something other traders don’t have, such as access to professionals, technology, better deals on commissions, etc. Most are just funding – which one can argue is proprietary. I’m doing it different however.

A lot of firms require the best of the best to take a trial of tribulations and hit some profit target while obeying rules. The guys that get through this are either lucky or talented. If they’re lucky, they will get washed out. So the firms are left with talent. The lowest hanging fruits, after the lucky ones wash themselves out. However, as someone who’s been in the trenches with retail traders, and talked to thousands of you all on a deep intellectual level, I’ve seen patterns between success and failure amongst traders. Mostly failure. My case studies with success is very minimal.

I’m very certain of what causes failure though. In my last post here, I talked about clarity vs confusion on context being a big one. However, that’s just part of the issue. It’s like when a plane crashes – it’s typically a chain of issues that feed into each other. Same with traders. Also, some of you may know how big of a proponent I am for psychology – especially the realm of how to specifically fix psychological issues. Hypnosis being the big one. I do have a 4 part series on my YouTube channel discussing hypnosis.

I’ve seen personal success for my self with this tool. I also see how it has influenced traders in a positive way, as well as acquaintances who use it for personal reasons outside of trading. So my finesse with this type of work gives me edge in the sea of prop firms.

Going back to survival of the fittest – AKA the traders whom have talent and pass evaluations, they don’t get access to coaching typically until after the test. Now, The Futures Desk is an exception. I am not an affiliate, but they are my money partner. My traders pass their exam and they work with us as a team.

Let’s face it, I need access to capital. We planned on using other combines, but they don’t like the type of thing we’re doing. Which makes no sense if the evaluation was passed. But lets face it a lot of them bet on failure. I do believe that model will shift as we see new players entering this field who actually care about cultivating talent, and traders are just sick of these bucket props. Keeping a ton of the split just isn’t worth it with the rules and denials of payouts these guys do.

At this point, I don’t need to worry about violating bullshit rules because the account is being split and essentially team traded. Futures Desk does offer coaching if you need it, before passing an eval. I’m a bit different and certainly no competitor. I have no openings for my firm. I have 4 traders and it will take a year or so of me working with a small team before offering any opening. And what openings are offered, well, there’s already backup traders filling those slots.

This is the difference with me. Bigger firms are taking the guys that are talented through their process. For me, I’m working with guys who can’t quite maintain an eval. Guys that have passed them but blow out. Guys that know what they need to do, but hit crumbling points after successful streaks. Guys that can get on base.

Have you ever seen that movie “Money Ball“? If not go watch it today and think of it from a trading perspective. It’s about a ball club that doesn’t have the budget of the big boys. So they’re not getting those top pick athletes. However, they hire this guy named Peter Brand who runs statistics on players. He formulates a plan where they leverage guys that can do certain things well enough like getting on base, but they’re not the talent of top athletes. They string together a team and get very far in baseball crushing it. This is my team.

Guys big prop would never look at, nor can they manage to get through the challenges on their own. I think there is a tremendous amount of untapped talent that never truly see’s the light of day, because they just need more guidance than what’s being offered. Because lets face it, nobody is doing what I’m about to share, so the pool of guidance I offer is almost non-existent.

The reason my team is small and I’m not taking anyone on – is my coaching style. It’s very intimate. I’m with the trader through the entire session. From the first trade to the last. When they take a loss, I pattern interrupt and we do a hypno breath work session.

My techniques can shift according to what the trader responds to.

Today, I had a full blown hypnosis session as one of my guys had a pit in his stomach because of volatility. So I helped him completely remove it – otherwise it would have festered into a bigger problem through the session. I’m training these guys to be consistently in a state of calmness. Emotions are a massive issue with traders. Even if they know what they need to do.

Some prop boss who just says “you got to stay calm and trade the system” – News flash – this doesn’t fix the problem.

Sometimes, fear is a tactic to adjust the trader’s behaviors from big prop, but that pressures the trader more. While it can work, there’s a breaking point and the pressure build up can lead to catastrophic failure. I also have another tool in the bag that gives me edge. Just like Peter Brand using spread sheets to run stats on ball players, I have developed TradeCraft. Its my tagging software that is designed in a way that allows me to comb through trader’s statistics the way I want.

I’ve been so boxed in and pigeon holed with other journals out there. Originally I was going to use another platform, but they refuse to let sierra chart users on to it. That was not going to work.

The only work around was to build my own. So it was born out of them rejecting my request as I talked to the owner. Told him I’d make a bunch of content and it would be great for their business. They were nice enough to give me a year of free master dash where I can monitor the prop traders, but platform rejection of Sierra Chart just was not cool. Plus their tagging really was lacking.

By the way if you want to see how our journal syncs and works with Sierra Charts – check out the TradeCraft/ Real-Time Sierra Chart integration here.

The TradeCraft platform is tagging focused, because general statistics suck. You need specifics. Just like specifics in psychology. You need specific stats, and no AI or journal will be able to figure out what data points you’re trying to measure. I’m a very analytical cat.

So having a platform designed to allow for full customization, that fits the specific trader’s profile was needed. My god, this platform is about to get much crazier where we will be doing things you won’t see anywhere else. One thing we recently implemented, is the ability to take your recorded sessions – which I’ve always recommended recording to YouTube, as its free way to store big files without killing your PC. You simply stream an unlisted or private video to the platform and – boom you have a video file.

Anyways, the problem with YouTube is you have to sift through months and years of footage to find a trading session – THEN! – hours of footage to find your trades. So I use to export my trades, get the time stamps, find the first trade in the YouTube footage, figure out how many minutes in the video it was, put my trades in a spread sheet, run a formula to calculate what time in the YouTube video each trade is at, generate time stamps, and then put them in the description of the YouTube video – as descriptions with time stamps will jump to that section. So essentially, I could find each trade faster. The problem is those video files get buried – which, unless you’re embedding the file to the journal, they get lost. But you have to open the actual YouTube video in a separate browser and find the timestamp and make sure that’s the trade you’re trying to analyze. And when doing monthly reviews and wanting to look at recordings, its a fucking pain in the ass to sift through this shit really eating into review time.

The TradeCraft platform requires you to just upload the video, figure out what time of day the video starts and boom, all that shit is generated. Then as you go through your journal and select each trade, the video is embedded on each trade and that video is meshed to.

So if I go to trade 4 of the day – the video will play right at trade 4. I go to trade 10 – the video starts at trade 10 and is again attached to trade 10 with your tags. So I see my tags, the trade statistics, MFE / MAE and all the stuff you would see on a trade plus the trade recording is attached right to it. You can learn more about this feature here.

I can look at one of my trader’s equity curves in their main dash, and go “oh that’s a big win, what happened?” I can click on that part of the equity curve and it goes straight to that trade in your daily journal in the blink of an eye and the video is ready to go – so, it can be either auto played or I just hit the play button and the trade just starts. So I can see a recording of my trader’s trades when sifting through stats in seconds. I can also enter in say – 10 seconds in the box above the video and the trade on the recording will start 10 seconds before they execute. Maybe I need more context? I can enter several minutes if need be and every trade on the journal will play a few minutes before the executions.

No one is doing this…. Plus the price of TradeCraft is fucking competitive as hell.

Also if you take breaks during the session and have multiple recordings – you can easily paste the multiple videos and they seamlessly mesh with your trades for the entire session. It’s fucking sick as hell. And if you guys think so too, just wait. Just wait and see what the fuck we’re cooking up. It’s going to make everyone’s journals look out dated.

I swear, some of these journals are just programmed by trading enthusiast who are not hard core traders that actually use the fucking tools they built to full capacity. Plus, this is my brain child, used for prop traders and built to have a faster work flow, so the review process is quicker and you can find edge sooner, as well as get access to more information than anything else out there.

This is my way of really helping the community with solid tooling. Tooling that was product of rejection. We also have rolled an affiliate program as well. I do really believe in this thing with all my heart and want a solid product that people genuinely find useful. So the guys that love it can make money on it.

At some point – I will have a master dash built for prop traders. So I can real time manage all of them. I also have guys that aren’t trading for the team – but rather are being trained as risk managers, and they’re going to learn how to use the software to run statistics on my traders. As much as I’d like the athletes to run their own stats and sift through it all to find the edge, I think multiple eyes and guys who are dedicated at this is beneficial for us as a team, as well as the individual trader. This way, our intimate knowledge of their stats can help us know if certain pre-loaded tags (tags added to a trade before the trade is executed) is a place of extreme edge. That way we can talk to the trader in session to encourage sizing up and help guide them to being consistently pushed to a higher level than they can achieve on their own.

We can also help them stay out of bullshit which I did with one of my guys today, thus preserving their account.

Team Trading

I believe being with the trader the entire time and hand holding them, is the way.

Real sports teams have a coach there the entire time. Correcting behaviors in the moment. Other prop firms don’t have coaches doing that. It’s end-of-day after the damage is done, or the trader panic cuts a big hold.

I give my guys a read on Price Action and it’s a delicate balance of letting them trade and me pushing them to hold or cut. I’ve done this in the past before this prop thing. And the traders think that they get more value from that hands-on style of coaching on the hard right edge then just listening to me narrate for months on end. This is how I know this method works. Traders need this.

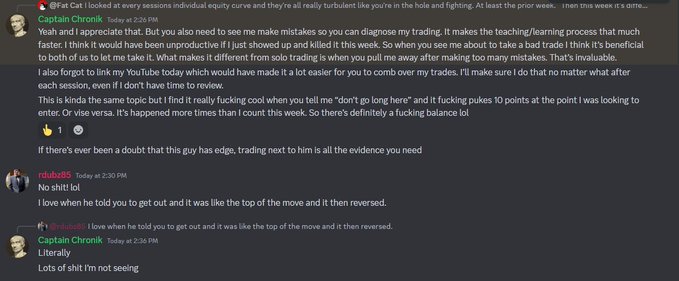

This is why I can only take on a small team of guys, because it really is team trading, which retail leveled props you all have access to doesn’t offer. You’re on your own, and for some, that’s what they prefer. Below is a screen shot attached with my prop trader and my discord admin. They’re confirming this style of coaching. It also helps to sit with someone who knows what’s going on in the markets as well.

Because some coaches don’t trade. Not saying that’s not still valuable. But I’m coming at this with a lot. A ton of my energy is being poured into this and I get paid only when they succeed. I’m the risk manager, coach, psychologist, and team mate.

Team trading really has some promising things going for it. SMB capital has talked highly of traders doing well on joint accounts. I remember some hater telling me trading is not a team sport. Well, that’s absolute bullshit because at this level it is, and it can be, and I will show you all, because there is a fire burning in my core, and when someone has that. They can achieve some crazy shit.

Now there is nothing stopping you and a buddy joint trading. Reach out to The Futures Desk and I’m sure they would allow it. I think with this deep level of cultivation, I can get guys from base hitters to all stars. Instead of running a traditional combine, where it’s survival of the fittest and churning through volume. I’m about quality over quantity.

I know this is going to be hard. It’s fucking difficult and it sucks when I lose a guy because he just leaves. That’s up front risk I take on. Sometimes the regime shifts and they start to struggle. One of them had their father pass away. I deal with their personal lives because they share it as they feel it affects their trading. It’s absolutely demanding as hell. But I won’t give up.

A Trading Pod on Steroids

The way I chose who could try out for the prop, was the guys that put in the work. Guys that consistently tagged and journal. Guys who diagnose their issues and created awareness around their trading. If you want a shot at it. Join the discord – it’s free. My YouTube videos have a link. The discord is only open every quarter. So April it will be open all month. Go to wave 2 back up traders and post. I don’t charge tryout fees.

Here’s the catch. There’s no guarantees I’ll pick you and if I do, it could be a year from now, plus, you have competition. I have 3 guys in back-up slots, now 6, as I made this post a few days ago and saved it as a draft. So chances are I’d rotate them in first. Unless you out work them.

Worst case scenario, I don’t pick you, but you created a very healthy habit that will surely improve your trading and you will create a bond with the others and you can talk to my prop traders and see them review. Most guys are lazy and most traders don’t want to do trader work. If that’s you, then consider fixing it or quit, because you are wasting your time. Time you’ll never get back.

I’ll be sharing more stories with my traders. Our struggles and our successes. I want to document it, so you guys know what really goes on in a tier one prop firm. Even though we’re not tier one – We’re nobody underdog retail traders – banding together trying to do some wild shit. A trading pod on steroids.