Prop Diaries EP3 – Choppy Waters

You’re about to read the most in depth post on what really happens inside of a prop firm. Not any prop firm. But a prop firm being built from the ground up. This is probably the first documentation on this type of thing on the internet. If you haven’t read the first two episodes in this unique internet saga, check them out here Prop Diaries EP1 and Prop Diaries EP2 – Being Thrown in the Deep End .Assuming you are caught up on my story. You’ll know I’m working with a prop trader named Chronik.This week for us did not go well.

You don’t just start a prop firm and expect things to be smooth. I mean look at trading in general. It’s arguably one of the most turbulent journeys one can embark on.

Last week, half way through it, Chronik’s performance started to slip. He almost achieved funding and, well, now we aren’t close to that goal anymore – which is okay! The name of the game is survival. If we have to chop around keeping his account on life support for the next 3 months – fuck it. We will.

I thoroughly believe this is where a lot of traders screw up. They just say “ah the hell with it, I got a free reset” and they blow it instead of trying to dig out of a hole. I mean, it’s easier to start over to hit say a 3k target than dig out of a 2k loss to then hit a 3k target – right!? But that just creates terrible habits. If you really want to do this for a job, there can’t be re-dos. You have to commit to digging out of a hole, floundering when regimes shift, and just be okay with it. Plus it builds character.

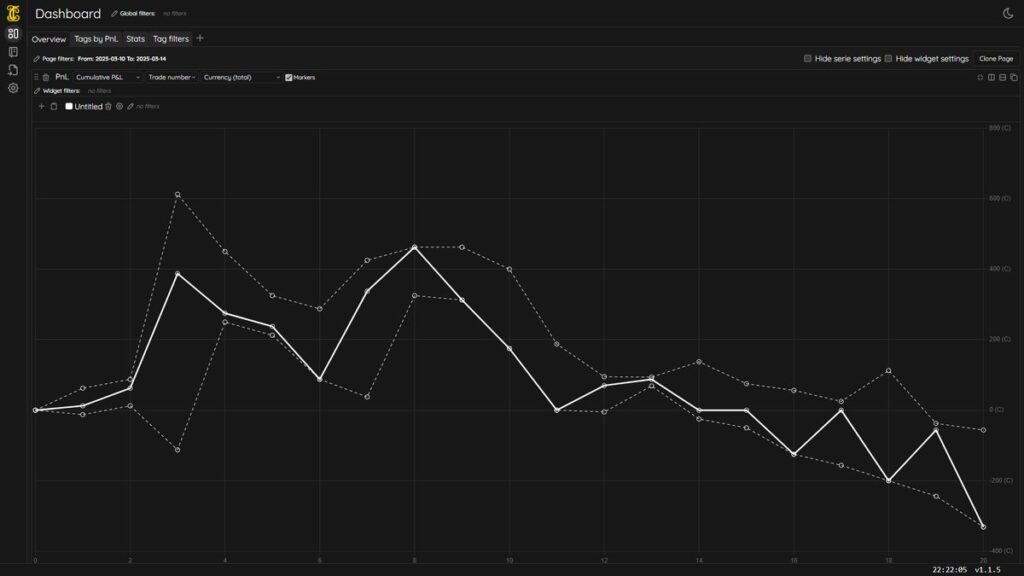

Here’s a photo of his equity curve this week:

By the way, this screen shot is from TradeCraft, a highly customizable trading journal I’ve created just for this prop firm journey. It’s seriously the most versatile journal and stat tracking software on the market at a very competitive price. As you continue to watch this journey, you’ll see just how in depth we can go with the stats and information provided by the TradeCraft trading journal.

Anyways, he traded Monday without me and did well. The two sessions we got together for he bombed. He only traded 3 days this week by the way. My concern is, how much am I influencing this trader? Last week, we did great the first 2 days. This week, he did better without me. The Thursday session he bombed (which really wasn’t that bad as we don’t let him go full draw down). I had been a bit flustered with my own trading. I’ll post a screen shot of my Thursday below:

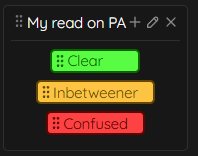

As you can see, there’s a pie chart on the TradeCraft platform called “Clear vs Confuse“. With TradeCraft, you can create custom tags and track them / filter them in a ton of unique ways and one of those is using pie charts. What we can see is that with almost half of my trades, my read on the market was not confused but a tag I call “inbetweener“. I’m somewhat clear on what’s going on in the market, but not totally clear. I actually wrote a post on how important being clear is as a statistic in your trading, which you can read here.

Being slightly clear overall doesn’t work for me that well as you can see below:

I’ve been tracking clear and confused tags since the beginning of using TradeCraft trading journal. However, inbetweener was first created on 2/10/2025. So the above photo is from that period to give you a look at every trade with those 3 tags. The reason I made the inbetweener tag is because sometimes I have partial reads on the market. I think when you are tagging over time, you start to ask yourself questions and naturally want to evolve your tags. The green line by the way is clear, and red is confused because red means bad and I track bad things with red tags, and the yellow is the inbetweener tag. Here’s those tags in their raw form to give you an idea of what they look like:

With the TradeCraft trading journal software, you can change the color of your tags and even edit them, because sometimes you just want to change that shit up and not commit to a fixed color or name for the rest of your career with tags. You need a huge sample rate of tags to really dial in your trading too.

So the issue is, I also have emotional tags you can see 3 pictures up. In that wheel, there’s some yellow. Emotions crept up on me in that session and for some reason, my heart was pounding. I narrate what I see to Chronik as he tries to model my trading 100% and I feel when I’m not 100% grounded, that energy sort of rubs off on him. Although I didn’t show it. However, it does affect the way I coach him. I feel like I may have attempted to press him to trade? Either way I don’t want to coach. But then again, I have good grounded sessions and he will flounder. Really, it comes down to skills. However after this session I had questions.

Modus Operandi

I wasn’t sure if my communication with Chronik was suited to his MO, which stands for Modus operandi – which is – an individual’s habits of working. Okay. We need to unpack some interesting stuff here, and anyone else that coaches traders or has employees – you may want to listen up. Or read up???

I was listening to a podcast with this Navy Seal on the Shawn Ryan show. Can’t remember who. Anyways, he was talking about how he’s an entrepreneur running multiple businesses and expressed how important proper communication is. He starts talking about these “Kolbey Index A” tests he gives his employees. These tests show an individuals MO. The way they work and how they process information.

So everyone has unique MOs. You ever meet someone and felt like they understand you completely?

That’s how I felt about Chronik. What’s wild is we both take this test and our MOs are virtually the same. Below are the results of Chronik’s Kolbey Index A test.

There are 4 parameters. The first one is how you gather information and share it. We both score a 7. This means we are very specific. If you’ve been following me for a while, you know this already by how I present my content. If you score a 1-3, you need simplified ways of gathering and sharing information. Which is interesting, because I have one prop trader whom I struggle to effectively communicate with – to the point I thought about giving up on him. However, I started to think his MO could be different. If he needs things simplified, then that means I need to simplify our coaching sessions to fit his MO.

That Navy Seal mentioned that if the military did these tests, they could have more success rates in Seal training. He also mentions that he uses them on all his employees. Well, guess what? His businesses started to thrive. Everyone has a different MO and this is how you operate. So tailoring work tasks or coaching around someone’s MO can have vastly better results.

The next thing is how you organize. Chronik and he scored a 2 and I scored a 3. So we adapt. We create shortcuts, thrive on interruptions, loosen up rigid processes. On the other end of the spectrum, if you score an 8-10, it means you systematize. You can’t just operate in an environment without a full blown system / checklist procedure, whereas Chronik and I can. That may be hard for a systematic person to understand. However, they need to allow others to operate in their MO, otherwise you won’t be as successful.

Next, we have the best ways of dealing with risk and uncertainty. Which is trading in a nut shell, when you trade the hard right edge. He got a 5 and I got a 6 again, being in the same area for having the same MO. We modify. Modify is in the middle. On the lower extreme there’s stabilizers. On the opposite side, there’s innovators. So we operate in between. I’m really interested to see different MO’s in this category with my other traders. I’m curious how that affects the way they trade – more so management.

Finally, is the last part of the test. Are you able to imagine results on the lower extreme or do you need to have them concrete and physically there for you to touch and feel? Chronik scored a 6 and I got a 4. So if you score a 1-3 then you can imagine the results; 8-10 you need the results to be concrete. 4-6 means you operate in both realms like a mediator. What’s interesting is I’m a 4, so I’m just on the cusp of imagination. Hell – I always visualize goals and future results in my hypnosis sessions. I have a solid imagination and really like to tap into it. However sometimes, I need that concrete to be like “oh yeah imagining results works“. Chronik, being a 6 has him on the cusp of the concrete, while still being able to tap into the imagination but not as close as me. He does mention hypnosis sessions and visualizations in our coaching helps him a lot. Makes me wonder if that type of work will even work with a trader in the 8-10 where they are so far removed from imagination?

What’s crazy about all this, is I can construct my teams (in case you don’t know I’m attempting to build trade teams) in a more effective way. I can have guys who have middle scores of 4-6 on certain categories mediate for me to guys that maybe on the other side of the spectrum from me. I can create teams who have the same MOs and they will understand each other better. I don’t know, but this is wild. Like I said, Chronik seemed to get where I come from and will. Our MOs are virtually the same. Now I have clarity on how I need to approach my coaching with him. Just be me.

Conservative vs Aggressive – Case Study

One thing I also did was make a mind map using the free software called obsidian. I drew out everything I knew worked for Chronik and what did not. I also had unsure and concerns that I needed to address with him. So on Friday, we discussed these topics. Now I made this before I got his Kolbey Index A test results. However the discussion we had was right after the test results.

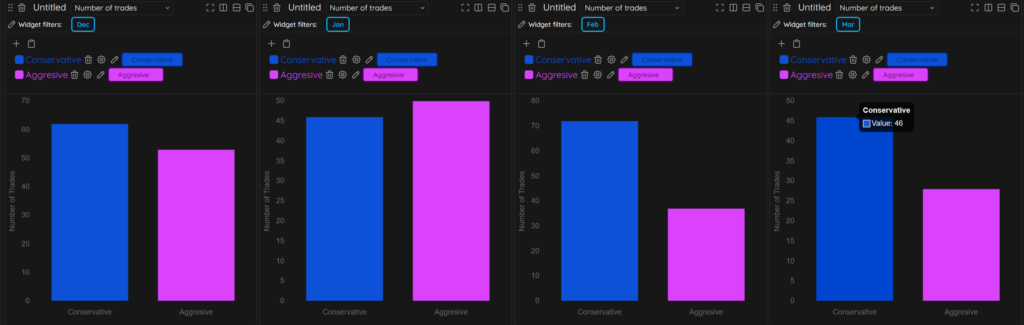

First thing is what works. And there’s something I found in his trade statistics on the TradeCraft Trading Journal. He has two tags: Conservative trading and aggressive trading. I looked at the equity curve of both overlaid and they are polar opposites. Conservative trading has this model up move on his equity curve and aggressive trading is a mirror inverse.

It’s crazy because I track those two tags and they both go up. However the aggressive trading has substantially harder pull backs when shit doesn’t work, causing a lumpy equity line. Whereas my conservative trading is just beautiful and starting to go parabolic. But that’s probably because the VIX is higher. My sample rate since using the journal back in 11/04/2024, which is when we first introduced tags for the TradeCraft software back in alpha testing. Anyways, my sample rate for conservative trading is 286 trades and aggressive is at 221 trades. What’s interesting is in this higher VIX environment, more conservative trading is just crushing it. Whereas in a lower VIX environment, aggressive trading did better, but it started to suffer around 02/17/2025

Chronik’s definition of aggressive and conservative, interestingly enough is different than mine. Conservative trading for me is basically fast scalping. For him it’s waiting for a ton of confirmation, which that’s the case for me as well. However, we notice I’m just faster at trading. I can hone in and identify windows of confirmation and execute on it fast as shit. I mean, I have 8 fucking years of experience trading ES. He only has a year. Aggressive trading for me is just pushing the trade and letting it slap around, breathing on the entry. For him it’s just almost a boarder line impulsive entry.

Luckily, if that’s the case with TradeCraft tags, you can edit the name if need be. And he can make a new aggressive tag and name the other one impulsive so he doesn’t lose his precious data and sample size attached to it. He also has been using the journal just as long as me and has a solid sample size of trades. Once you get that sample size it just makes the software feel more solid. You can actually find real edge in it.

Hell, a trade left un-tagged is a waste of data that you can use to find edge or stop doing what’s hurting you, like Chronik no longer being able to trade aggressive. I made it clear to him that it needs to stop. We would have never figured this out if we weren’t using the TradeCaft Trading Journal software.

I know I’m plugging the hell out of it TradeCradt, but it’s a solid product and I’m sharing with you how to use this thing to change your trading for the better. Because, I feel ultimately you guys would like to be better at trading???

Also, this is the type of work you should be doing anyways, and I also think seeing content about trading that’s more than “go long above this price and short below that price” is just not helpful. I want to see traders struggle and overcome it through some type of data and see what the solutions were.

Next on this list of things that work besides conservative trading for Chronik – is we did a visual / hypnotic hybrid session after a losing trade that just emotionally tugged on him mid-week. I actually share this process in this video below:

The session with Chronik was different however. You should be video recording your trading sessions for review. You can store the video files on to Youtube for free. So a massive library of trades.

With TradeCraft, you can actually take the YouTube link and put it into the journal. All your individual trades will have a time stamp generated for the part of the video where you took the trade.

Basically, you can click any trade anywhere in the journal at any time and instantly find a recording of your trade and the video will play right when the trade is initiated. Which is insanely convenient for me to review Chroniks trades. I don’t have to sift through multi hour video files to find the trades.

If you want to see this feature, check out our tutorial on it. It’s pretty cool and no other journal is doing this.

So Chronik and I pull up this trade in his journal and I have him watch it. I want to see if it upsets him and it does. Next, I put him into a trance state listening to delta waves and rain sounds. This helps him relax. I use an eye technique where you keep your head straight and look up focusing with the eyes. This has an effect on the brain where you can’t hold on to negative thoughts. I then have him take meditative breaths while I induce hypnotic language, putting him into a trance which then allows me to communicate to his subconscious mind. The place where I reprogram the way he views the market.

After I get him relaxed and in a lucid state, I have him re-watch this trade that triggered him. I feed him positive emotions as we watch it together. The trade was impulsive on his behalf as he tends to want to catch downward spikes. I have him visualize as if he didn’t take that trade, as if this price action doesn’t even phase him. I have him replay it a 2nd time. Then a 3rd. I know from doing this to myself the negative associated emotions don’t go away watching it once. Plus, watching it multiple times gives you more reps on that piece of price action. Therefore, he’s essentially getting better.

After the 3rd go, we go back into trance mode where I get him to relax again with some nice breathing. Basically, the same procedure I used to initiate this review in the beginning. Now that he’s nice and relaxed again, we run through the trade 2 more times as I have him visualize doing the right thing while I speak in my hypnotic voice. Which is a deeper soft tone of the voice. I then do another relaxation procedure and have him watch it one more time to make sure that – the price action he’s watching is no longer being associated to FOMO, but instead complete calmness, contentment, and patience.

Okay so we had very interesting results, and Ill let Chronik speak on behalf of himself.

“My session ended with a hypnosis session focused on my first trade, -175 stop out. It was a very unique hypnosis session where FatCat had me replay the trade over and over again while reinforcing a feeling of calm and disconnect from this particular price action. For years, I have had an emotional impulse associated with downward spikes in price. I always want to go long. While re-watching the trade the first few times these emotions were prevalent, along with a feeling of disgust.

Why would I go long there?

But as my breathing slowed and my mind relaxed I began to have feelings of clarity and focus. It’s been hard for me to “feel” these things in the past. But today I did, and it almost felt like being high on phetamines. My pupils widened and I felt zero emotion; just 100% focus. Through that focus, I came to the realization that this was actually an incredible area to get short.

I had multiple factors of support SCREAMING at me to go short. That feeling was almost overwhelming. The intention of the hypnosis may have been to make me disconnect and feel dull, which it accomplished to a certain extent, but it primarily made me feel clarity. I observed and digested information I had ignored in the moment because I had an emotional bias towards the price action. It was very revealing in how my mind comprehends and digests information. Accessing this frame of mind during my sessions and review is my #1 priority.

Okay, so he hit a narcotic feeling, which typically happens after successful hypnosis sessions. However this time was different. This shit really confirms I’m onto something with my hypnosis theories and leveraging it on traders.

Remember I talked about a list I built on Chronik? We’re still on it. So what doesn’t work for him?

-Contentment with PNL: PNL fucks with him at times. Even from prior sessions

-2 losses in a row is a trigger: All traders have a threshold. I use to be triggered by 1 loss then 2. Over time I did this type of work with visualizations, now I’m not really phased by much these days.

-Aggressive trades: I’ve already talked about this.

-Sharp down moves trigger him: again it’s been touched on here.

-Too zoomed on price action: he’s no longer operating with HTF analysis. Which even though he’s a scalper like me, you still need to know where the wind is blowing on the higher time frame. It just helps clean up your scalps.

Okay – with this list of weaknesses we are going to do a 30 minute hypnosis session and then it will be turned into a track he listens to every night. Which can be a problem. Remember when I talked about MOs? He doesn’t operate in rigid structured environments. He will do it at first, but then the habit may taper. However if that’s the case, I’ll deal with it as it comes. I do have a secret weapon which is actually a device. A very unique piece of equipment. However you’ll have to keep coming back to see what that may be.

Parallel Trading

Finally my concern and not sures. We talked like I said and I asked about drilling with me and trading with me? Is this bad or good? Well, after seeing his MO is the same as mine I realized it maybe good. He wants to master my trading system. However something funny happened. I stumbled upon a feature I didn’t think sierra implemented yet.

Chart sharing.

So I saw it and we started messing with it. Turns out when I draw on my charts it shows up on his. When I zoom in and scroll it does it on his charts. So we had like 20 minutes left before market close and I started drawing and narrating the session to see how he felt about it. He thought it was fucking awesome and it would be very helpful because now he knows exactly what I’m looking at.

We already came to a conclusion days prior he needed to have his charts exactly the same as mine. Now I’ll have him draw on the charts and train him on building context. He does also forget prior context. I’ll say “hey they’re only V flushing top side not bottom side so bottom Vs maybe invalid” He will forget and fade the bottom V and get stopped out. So if I have him draw this out – that means I don’t need to draw, which is cool. And he’s learning how to read context and by drawing, my hope is he won’t forget the context – which I know he’s reading this post!

While it wasn’t a good week PNL-wise for him, it was a good learning lesson and because of the choppy waters we endured this week. We now have a solid plan of attack. I hope you guys enjoyed this or are enjoying the series in general. One of these posts takes hours to create.

Check out TradeCraft and get one week free trial, no credit card required. It’s my baby. And it’s one of our weapons to get Chronik good at trading. As well as myself, that’s for sure.