Prop Diaries EP4 – Team Trading

All I can say is, if you’re struggling in trading – chances are you need accountability.

Accountability comes in many forms; and it could be as simple as reporting to another trader end of day. It could be trading with a buddy during the session. Or it could be sitting with a mentor. Something most traders don’t have access too.

However, that shouldn’t stop you from finding an accountability partner. The reason I share this – is my prop trader, Chronik took 43 trades today… I wasn’t with him. In case you’re unaware, I have been documenting the growth of the prop traders that I’m personally mentoring. You can read the entire saga in Episode 1, Episode 2 and Episode 3.

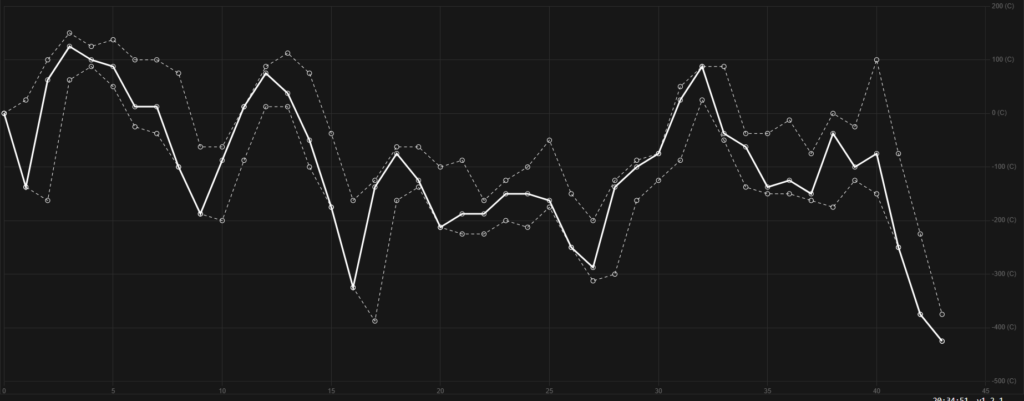

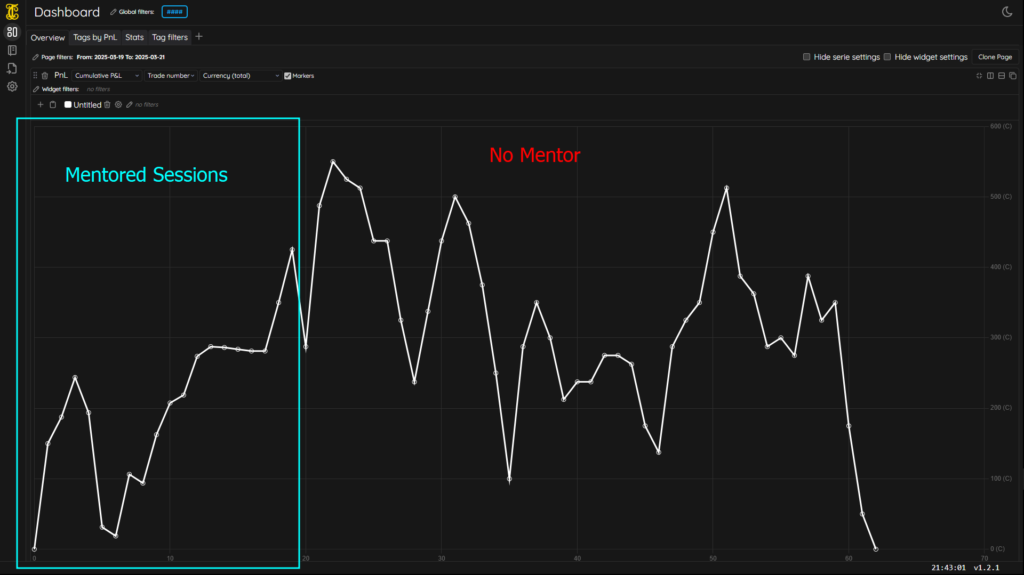

Anyways, here’s his equity curve on the Tradecraft platform:

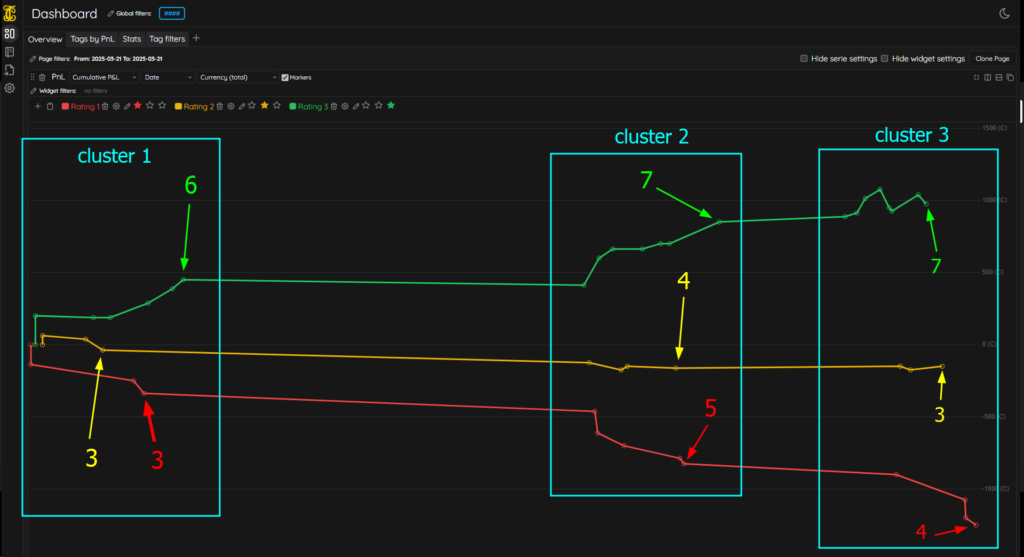

When I use the rating filter at the series level on Tradecraft, you can see that he took 12 red star trades. The rating system is pretty important and you can check out our tutorial on it to see how I use it here.

Now, what this is telling me is he’s taking a lot of bad trades. 43 trades alone is too many. When we look at his equity curve from the first screen shot, it’s really choppy and slants downward. The issue he was experiencing was that he was trading confused. Which he has a tag on and I wrote about clear vs confused trading, which is so important and this exact post is why. If you want check out the original write up on clear vs confused trading here.

Okay, so we have 12 red star trades which means he knows he should have never taken those trades. What we can do next in Tradecraft is filter by date. Which actually filters trades by time during the day session.

Notice how there’s 3 clusters of trades followed by flat lines. Those flat lines are periods where no trading was being conducted. I labeled each rating with number of trades. So the green lines are what he considers solid trading. Yellow means he needed to make an adjustment in management but it’s not a terrible trade. And red is just no reason – impulsive trading fueled by confusion, emotions or a mix.

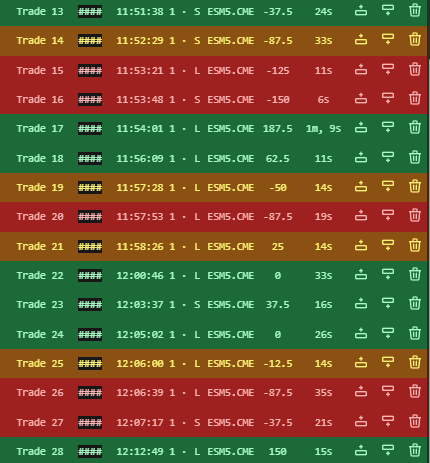

Here’s the first 12 trades before he stepped out. Notice the distribution of reds and greens. Again, this being ratings, it hints to some emotional swinging going on when you have reds and greens mixed evenly. He would have been just above breakeven after trade 12.

I do believe every trader has a point where they fall apart. You can handle so many trades, so many fights before you give up. Impulsive trading is typically a trader trying to relive some kind of discomfort. Which really cause more discomfort because impatient trading just leads to losses. So the temporary relief is very short lived when the button is pushed and it didn’t work.

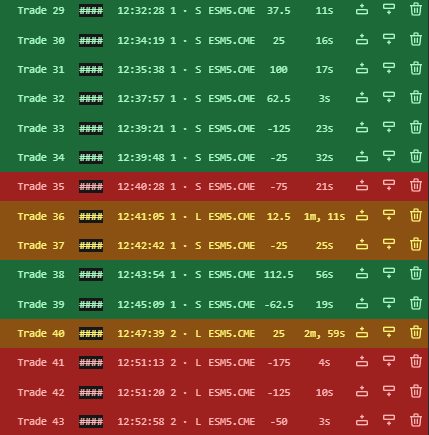

Okay so on to cluster 2:

The red stars amp up a lot more at 5 trades. So if he took a break, the issue didn’t get fixed. This is why I needed to be there. I needed to give him a hypnosis session and totally erase his discontentment of his PNL and calm him down. Something we established as an issue. It’s clear this is a re-occurring issue and now I’m starting to see the severity of it. Plus, my read on the market may have given him way more clarity – which I can’t emphasize enough.

Again we have a cluster of mixed reds and greens giving his equity curve that choppy look. At this point, he would be down closer to -$200. I don’t have his commissions on his stats so we need to factor that in.

Now, he takes his final break coming back and rips his PNL up on a series of green stars. Notice the time stamps; they are done in a rapid fire order. Just because they’re green doesn’t mean that they are all good in my opinion. Those time stamps are too clustered, showing he’s still over trading. Now, I’m sure he was clawing his way back to just below break even then he fell apart. And the final 3 trades were him almost giving up.

I know a trader on a different prop desk. I asked him if he noticed common themes when traders fail. This prop has a tryout and it’s pretty rigorous. There’s guys that will spend a quarter of the year grinding out on a sim – get funded – then blow out.

This trader told me they fight really hard, and when things get really tough, they almost just want to give up secretly and blow out. I’ve seen a lot of equity curves like this with developing traders. This seems to be common. It really is emotionally fueled then they just give up.

As I stated earlier, you can only tolerate so much of a fight before you give up.

This is why accountability is so important. Having a risk manager who can identify this can pull the trader out of the ringer before they blow up.

Below are the two sessions with me in the blue box. Outside is what we just went over

You can see we made progress and it only took one day to blow out 2 days of meticulous focused trading.

The thing is, I want to see how he can handle his own. Which this is the longest he’s ever held an account. So there may be some underlying contentment issue which I know there is. He’s also mentioned he has a hard time of letting me know when his emotions are all over the place. It’s like they’re buried so deeply in his subconscious, that he’s not fully aware of the very small bread crumbs that are red flags.

Now, I’m not upset. I told Chronik that if we flounder for 3 months on this account – I’ll be happy. Because after all, floundering is the step between losing all the time, and consistency.

Getting Funded – The Right Way

Don’t get me wrong, I’d love for him to get funded, because I’m coaching for free and we split everything 50/50 after funding, which some traders have told me is steep. But if you followed this saga, you’ll notice how much work I’ve put into him. I’m taking a lot of up front risk by doing this for nothing – which I’ve had traders dip on me deep into coaching sessions and disappear into the void.

Plus, would you rather have a 50/50 split and make 6 figures for the year or have a 90/10 split and lose money for the year on blown combine after blown combine?

I really can’t speak on behalf of other traders that are consistent, because they are pretty rare. However, any trader I’ve had ride it out with me in the trenches seem to have the same story as mine. A struggle of just screwing yourself into oblivion over and over. It takes real hard work to stop it from happening, and it’s my belief a battle buddy can really prevent you from going over board.

If we look at Chroniks mentorship, we had 3 wins in a row the first session coming right up to his profit target. We’re using The Futures Desk, and if you go past the profit target they raise it. Well, Chroniks done that. So he went from a $2200 profit target to a $3000 profit target. Some traders hate it. But if you can’t stick within guard rails on the winning side, then chances are you have no self control on the losing side. A good trader will stay in their lane and have the confidence to grind it out. After all they want to see consistency.

That’s something I’d like to address: The atrocious habits online funding creates. Instead of traders trying to grind out of a 2K loss to hit a 2K funding target, they’d rather blow it and start over. Because after all, grinding out of that loss means they need to make 4K.

If you want to do this as a career, you’re going to need your forever account. An account you have to cultivate no matter how ugly it gets. You have to fix it if you want to do this as a career. I think a lot of traders who are serial combine goers have just created a bad habit that will be tough to break if they just say “ah fuck it – I’ll just reset it“. Chronik has admitted to this being an issue for himself.

So after his first session with me, he trades day 2 of the week by himself in the beginning. He’s down -$100 or so. We sit down together mid-afternoon, because I can’t wake up for shit and just roll in mid-day all the time. I get him lined out, we start trading and he gets into a loss. I pull him to the side and we do a hypnosis session.

In this session I reinforce the fact that professional traders will be down in the beginning in certain sessions and they can dig out. I whisper confidence inspiring thoughts into his subconscious mind and get him dialed in mentally. Something we know for a fact works.

These hypnosis sessions are just a complete memory wipe and he’s good to go. Good luck doing that on your own. After all, it’s easier for us to see when someone else is slipping up then it is to see it in ourselves. This is why the team aspect is important.

How to Read the Market

Another thing is, I told him “Hey, the market is slipping heavy – it’s roll over – and it will be a type of price action that’s designed to shake scalpers out of good positions. So let it chop a bit on entry”. That’s one thing I’m good at after trading for 8 years in just the ES eminis. I can quickly tell what the condition is and how to finesse it. Something I think Chronik lacks in. I mean, after all he’s only been trading ES for a year. It takes several seasons to grasp it.

Getting him locked in on the finesse certainly gives him edge. I also have the ability to read the noise on 3 second charts and understand when there will be a pattern shift. Now, I know some of you may be thinking there’s no patterns these days. There is:

-Slips

-Reclaims

-Compression

-Liquidity zones

-V flushes

-Inventory clears

-Top / bottom ticks

-Fake outs

-Struggle grinds

-Ranges

-Trends

Small time frames experience regime shift more frequently than higher time frames. So you do get trends for 20 points intraday as of the time of writing this. The way these patterns compliment each other creates contextual cue, which allows me to build a narrative. Price action in my opinion is king.

So the ability to read it and formulate a story is just pure skill and experience at this point which really helps Chronik focus on trading my narrative. He doesn’t have to generate it nor will he forget as we share a chart.

With sierra charts, I can draw on my chart and it will draw on his end. If I zoom in – it zooms on his screen. We’ve come to the conclusion this helps him identify what I’m looking at a lot faster and more precisely.

Another thing we’re doing is taking screen shots of charts and drawing / writing the micro patterns, the time frame of the chart and putting them into TradeCraft, thus creating a book of charts. Which is a newer feature on TradeCraft.

I’ll admit I didn’t plan on using the book of chart feature myself. I’ve done it in the past on Google Docs, and It’s something I just never would dig up again. With the book of charts, it’s actually really easy and fits into the filtering system on the main dash. You can just pull up the book of charts widget and go through it.

Now, I think it’s confusing if you don’t mark up the charts. Chronik seems to praise this and he claims it helps him really understand my system. I imagine it’s like note taking. Writing things down just helps one reinforce what they’re learning and if you write on your charts. It’s almost like you’re getting another rep in on the trading session. Then, as you review them flipping through each one – you start to internalize the setups. I do enjoy it as well. Like I said I use to do it and for me it’s enjoyable.

Chronik told me he needs extreme accountability and we’ve since reviewed his Friday fuck-up.

So, coming into the next week, he’s not to trade without me. And he’s going to listen to his hypnosis on an extremely low volume during the entire trading session. This is a tactic to sort of feed his subconscious mind the ideal habits we need him to make.