Prop Diaries EP5 – Solid Footing

We’re going to look at the Trade Craft Trading Journal, and see the progress of a prop trader. This is an ongoing saga of the development of a trader trying to find consistency.

If you want to check out the entire story check out my blog here.

My trader named Chronik, has been coaching with me for a few weeks now; 5 weeks at this point. It’s been a struggle to get him consistent. The test account he’s trading to get funding with has been floundering. I don’t expect perfection with a developing trader in 5 weeks. I just expect progress – which we’ve made.

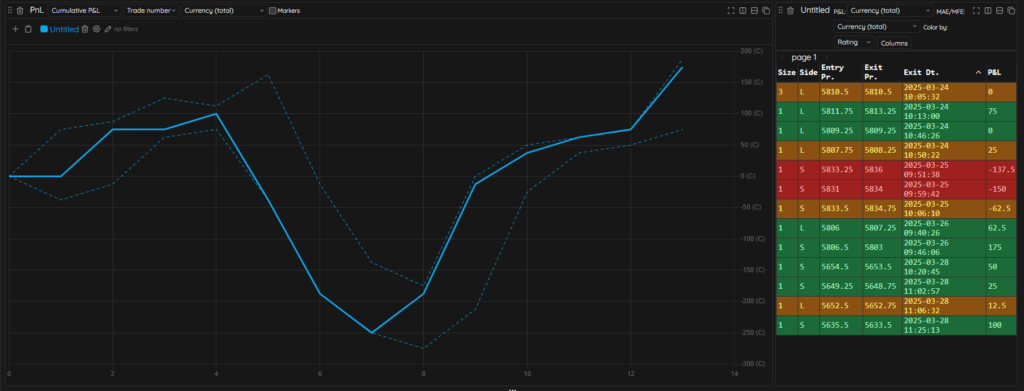

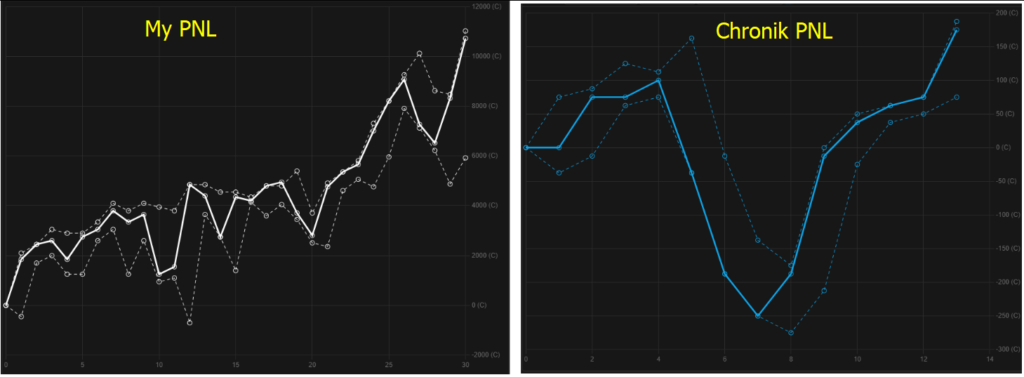

Here’s his weekly PNL curve on the the Trade Craft Trading Journal:

Okay, so we can see there’s a giant dip and he’s up $175 on the week. So what happened?

Chronik, after last week’s blow out on Friday, was not allowed to trade on his own this week. We had traded together for 2 days that week and he made progress. I let him try on his own that Friday and it all went to hell. That story is here.

Needless to say, we put together some solutions. One being he can’t trade un-monitored. Monday of this week starts off well. We don’t trade the entire session. This is someone who works a job. So if you’re a part time trader than maybe this will inspire you? Because ultimately I need to work around this schedule. Plus trading all day usually leads to poor performance do to fatigue.

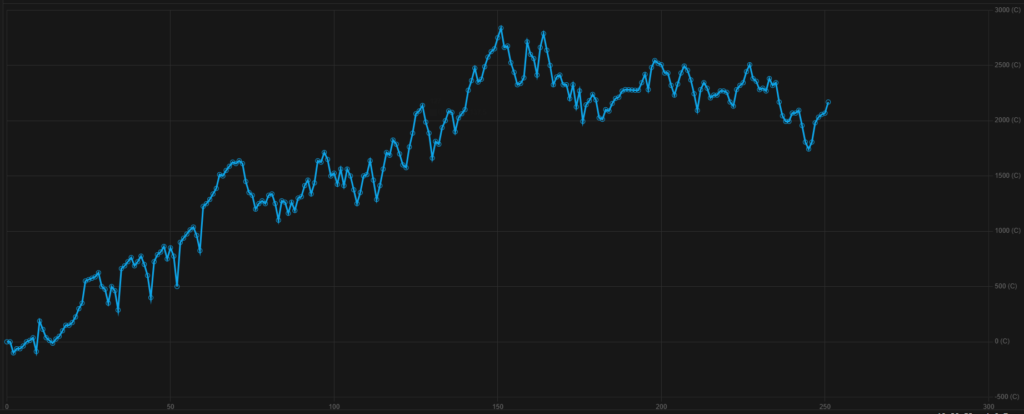

He locks in $100 on Monday. It may not seem like a lot, but with a bit of size that can make a huge difference. Obviously, he’s size limited right now as he needs to pass an evaluation for funding. Which if I’m not mistaken, was a $2200 goal. But he made too much on some days which bumped his profit goal to over $3000. It sucks because the PNL has dipped. Here’s a screen shot of the Trade Craft Trading Journal of all of his trades on the account so far:

Now, it’s not beautiful, but what’s a win is this is the longest he’s kept an account alive for. You also can see he almost hit $3000 in profits and it just unwound. Sometimes, traders choke when they’re close to targets and even after funding.

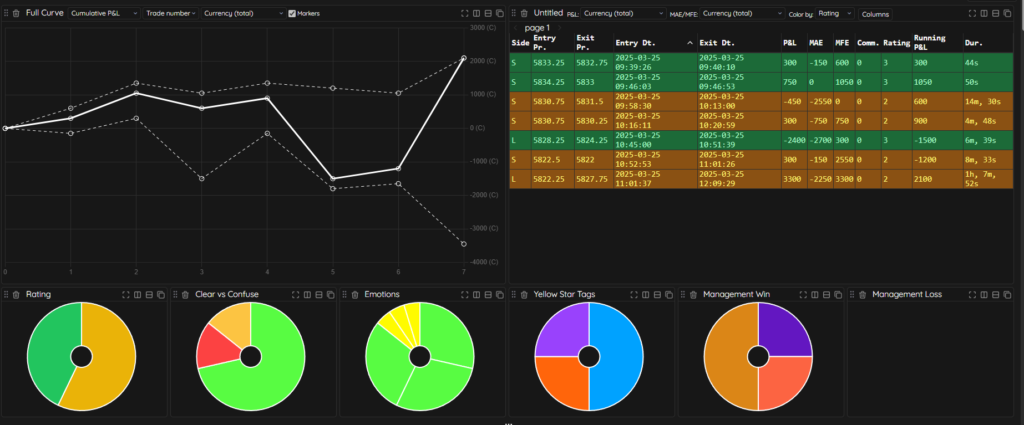

Now, if we look at the first screen shot – you can see how Tuesday dipped in hard. Since Chronik and I trade together, my read on the market and my clarity affects him. At least that’s my theory. Tuesdays price action was so different that I started to really struggle with it. Here’s my Tuesday session from the Trade Craft Trading Journal:

You can see how my PNL curve has a wide MAE and MFE. I didn’t have a good read on the market and the price action was just very different than what we had been experiencing. That’s what makes trading so hard; each day has a different flavor, so your approach as a trader has to shift. After doing review, I realized I missed certain patterns that were crucial for context. My management was also off which is signified by the yellow on the PNL. More importantly, I took a good trade that just turned into a big loss of -$2400.

Sometimes you get slapped on a good trade idea.

So that really hurt. I also shifted from scalping to attempting to hold.

On Tuesday, you either could grind ticks to survive or if you attempted any small hold for a few points you would get chopped on entry and have to deal with drama by sitting in the trade for longer periods of time. Chronik was too tight and couldn’t run larger risk required to handle the chop. So being very diligent about hitting into a quality trade and just scalping, it is the alternative which he didn’t pull off. The trades would chop on his entry and he did have some opportunities to pull out for small wins on each trade. However, hesitation caused him to get blasted. Had I been more aware, I would’ve had him size down and run larger risk.

I remember how there was a change in character, which got us to both go short. He got immediately stopped and I took on risk and let it breathe for what seemed to be 20 minutes. I ended up cutting for a smaller loss, then the trade would have worked. However, the abnormal price action was something I wasn’t in tune with. I feel when I’m having a hard go at it – this affects Chronik.

Obviously, he was down pretty much near daily draw down. If not, he did hit DD (daily draw down); 3 losers. He did give two trades bad ratings, which means according to him, they were horrible trades.

Trading really does require one to not take bad trades.

The room for error is extremely small and does make the difference between the bottom line. It’s really challenging and sometimes feels like you’re performing to your max abilities, just to print a green PNL. Coming out of that and sort of giving up hitting to hit without any solid management can blow out days if not weeks of work so easily.

Sometimes, you just have off days where reading the PA is hard and it happens.

However, after that we really turned things around in his results. On Wednesday, he turned into a trading god. He was just trading so perfectly coming right up into profit target pretty quick. His read on the market was so damn solid. He did a lot better than me. I got into trouble in beginning of the session, being far too aggressive. Now, I did get out of the hole. However, was in Chronik in the zone.

I ended up having him give me a hypnosis session to get me zoned in. I do find it helpful myself to trade with another trader and have them be an accountability partner. I certainly do better quality reviews with him. And having a hypnosis administered from someone else certainly allows me to slip into a trance sooner.

Another thing is, I need to posture Chronik into a leadership position. I’m only one man and if I’m to build a prop firm I need someone familiar with my edge to help me teach other traders. Someone who can also learn to administer hypnosis sessions.

Hypnosis sessions are extremely important. Traders absolutely suffer from psychological issues when doing this, and that can be the difference between consistency in green PNL vs failure. Putting a trader in trance and reprogramming their subconscious mind has been working for myself as well as Chronik. This is an edge we have. Having Chronik learn to administer these sessions, allows him to understand it better.

Teaching is such a powerful tool. Part of why I enjoy it so much is it allows me to become a better trader technically and psychologically. Teaching forces one to attack things from multiple angles, which actively works the brain out. Teaching is like getting extra reps in at the gym and watching your students improve, which reinforces your confidence that you know you’re on the right path.

Once Chronik gave me my Hypnosis session, you can see how my performance was boosted. It might be a good idea to have a tag for this. To see what happens after a session is administered to the PNL.

We didn’t trade Thursday. He had work and I had other things to do. Once Friday rolled in we were at it again. Chronik was in the zone again. Just crushing it. We didn’t hit profit target, however he said he was content after a bigger scalp came in.

One thing I did notice with Chronik, was his hesitation to execute on Friday and it was like that at times earlier in the week. Almost like his prior Friday session haunted him. I did ask about it and he mentioned he felt good. However, something I notice in myself as well as other traders is when we notice we went tilt and were too aggressive, we tend to dial it back in too much. Where we become almost too conservative; really leaving good trades on the table. It’s all about a perfect balance which can seem impossible at times.

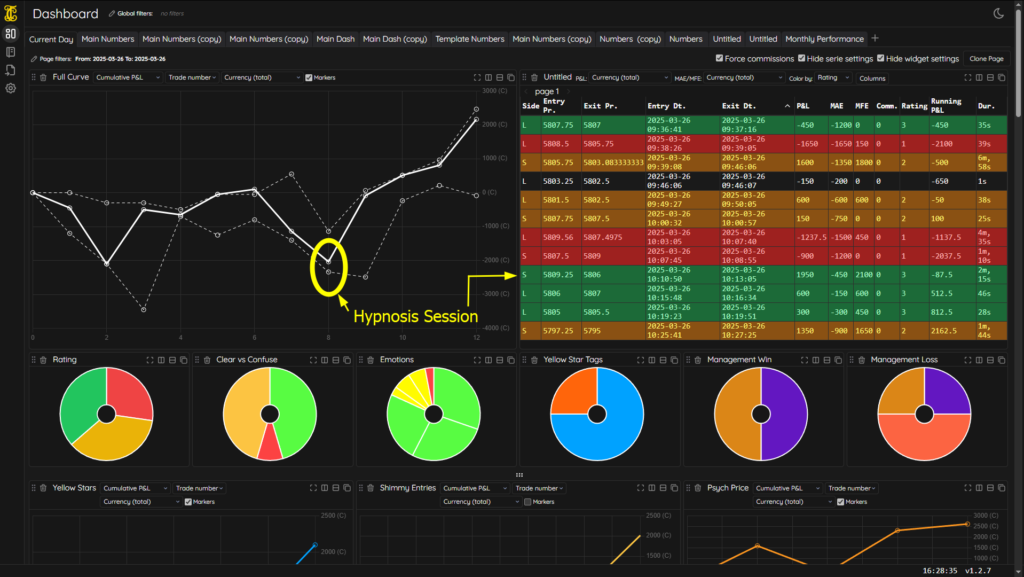

For Chronik, it’s also a skill gap between he and I. I’ll share our weekly performance so you can see the difference in skill and experience. Here’s a screen shot from our Trade Journals.

I’ll say, this is not a pretty weekly curve for myself. I took 30 trades vs his 13 trades and we sat watching the screen for the same amount of time. It’s also about seeing the opportunities as well. He did see a lot and let a ton slip through his fingers. He even can tell when I’m putting on a trade based off what he sees. After all, we share charts of Sierra. So when I zoom in, it zooms in for him. When I draw lines it draws lines for him.

I think if he was more aggressive on certain trade ideas, his curve would be a lot prettier. So obviously there’s an over correction into conservative trading which I addressed with him a few weeks ago. He certainly took that to heart, now it’s a bit too conservative. He sometimes waits for too much confirmation, when in reality he needs to take a shot.

Another issue I notice is he’s willing to paper cut losses instead of pick up a tick or two. This can be the difference between making or breaking you. I had several conversations about this with him. Which he did make some adjustments toward.

Really knowing when to scalp vs hold certainly can be a tough one. It was pretty tough for me to figure out when to do one over the other.

Okay so I need to remedy his slowness. We’re going to drill each day next week. I need to get him out of hesitation, but also the ability to cut trades. More importantly, continuing to build his narration skills is important. I think we’re getting there. I think he’s getting sharper. He just needs more time in the oven.

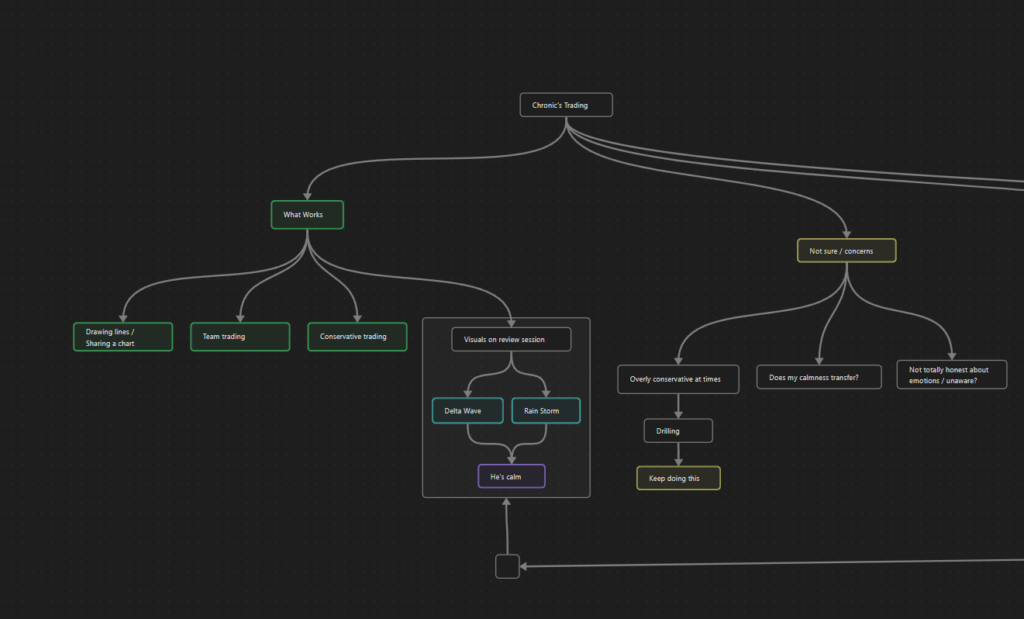

We ended the week with building and adjusting his trader profile I’ve built on him as you can see below:

We’ve known visualizations on reviews helps, but we didn’t do that this week. Nor have we done it much. What we’re going to do is clean up his book of charts which is a feature on the TradeCraft Trade Journal. You can put in screen shots. We use a screen shot software called flame shot. This allows us to quickly label charts like the one below:

This is mine. At the top left you can see how I label a 10 second chart so I know what time frame this screen shot is from. You can also see on the left how it says “ME” which means “my entry” “MX” is “my exit” and finally “IE” is “ideal exit”.

At the top middle it says hold more which is a tag I’ve created in the TradeCraft Trade Journal. As you can see between the ME and MX marks on the chart, there was a lot more I could of held for which is the IX.

Now this isn’t hindsight. I knew this could have been the case and I just cut, a habit that even I struggle to break. Now I’m getting better, but the problem is having just a hold more tag without marking out the charts doesn’t give me enough information. Each pattern and setup is different, so I need to visualize these things by flipping through my book of charts. Going into a hypnotic trance and just having someone talk me through each trade as if I did hold more. This is what we’re going to do with Chronik each week once he gets a better handle on marking his charts up like this which he is.

Another thing that helps is team trading. He’s starting to call out things I miss, which has helped me make better decisions on Friday, when he mentioned flat bottoms on the chart were V flushing.

Another thing we now can confirm that works is constantly marking up charts. And doing it in the review sessions each day. Yes, we’ve been reviewing together, this is something he’s really enjoying and gets him excited. So leaning into what he enjoys can be very beneficial.

I’m excited to see what this week brings. Until the next blog post. Check out TradeCraft trading journal. It’s a tool we’re always building and refining. We use it everyday ourselves and it’s proving to be a solid accountability partner.