Why Do Most Traders Fail?

Is it not sticking to a strategy? Is it psychology?

These are two things you see a lot being thrown around in the echo chamber of the trading sphere. But the problem is, these theories are not statistically backed up.

I’ve built software to track very specific statistics in your trading. As some long time subscribers may know, I preach trade tagging. I’ve written a lot on it before this software was developed.

It’s my brainchild and it focuses on trade tagging, making it easy to execute. TradeCraft allows the trader to really dive deep into the statistics, unlike other trading journals, which really limit your tag filtering abilities.

It’s been in use since the beginning of November 2024. It was designed for my prop traders, as I needed a tool to look into their statistics without being limited by platforms. I’m an extremely analytical person, so I like to see charts, graphs and every bit of data possible, while being able to have full control over filtering through their trades.

One thing I had them do and myself included, was track clarity on the price action. I also had them track their emotions, and of course they track their individual technicals. Since they’re all unique in their approach to the markets, the technical tags are going to be different. Putting that aside, we all have the same exact tags for emotions and price action clarity.

What is price action clarity?

It’s the ability to be clear about what the price action is doing – no shit Fat Cat – Hold on a minute. It’s more than that.

It’s important that traders read the noise. All that chop on 10 second charts tells you a story, and since price action is fractal, you’ll see the turning points before someone filtered on higher time frames will. Plus, scalping statistically performs best for all my prop traders, but that’s a different story for a different time. However this is why they’re looking into lower time frames.

When you operate in the “noise”, you’re able to forecast micro movements. Now, most of the time, you’re not trading some of these micro movements, because a setup may not be ripe enough yet. However, the better you can forecast micro moves, such as a little stop run, or reclaim being taken back, the more you have your finger on the markets pulse. In turn, this means you’re in the sweet spot. You have a good read on the price action; therefore you have market clarity. The more you can predict little bumps and lumps in the noise, the more in tune you are and the more clarity, the more likely your trades will work.

Statistics in trading is crucial. Otherwise, I wouldn’t be writing an interesting post about market clarity.

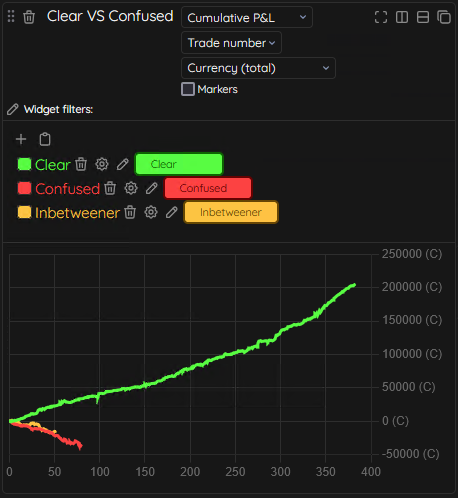

So the two tags we used were:

-Clear

-Confused

We used these since the beginning of November.

Confusion about what the price action is doing is hands down, one of the biggest killers on all 5 of our equity curves. Some statistics are elusive. And often you need to dig further by comparing confusion with other technical and even emotion tags to see what’s really getting to you. Confusion can be triggered by emotions or it can trigger emotions, if it goes on long enough in a session. Sometimes, specific price action patterns cause confusion.

However, from a more general and broader perspective, confusion is bad. But I know you think this is pretty obvious. Until you tag every trade for so many months and look at these two tag combos across 5 traders, it becomes very eye opening on how bad it is.

The thing is – it’s not obvious. The reason it’s not as obvious as one would think, is because when most traders are confused about price action, they aren’t even aware. If you’re not aware of it, then how will you fix it???? 🤷♂️

It takes actively tagging during a live session – not review – to be aware of it. And in turn, when you tag your clarity on price action – you then become aware and can take the necessary steps to fix the issue.

Building Awareness of What Works and What Doesn’t

So much of trading is building awareness around what the hell works and what doesn’t. Otherwise, you will just live in the dark and do the same thing over and over and over and before you know it, you’ve been trading for years without any real progress, and quite frankly – that’s pretty scary. Just pissing years down the toilet. Time you’ll never get back…

Any trade un-tagged, and not reviewed, is an absolute waste. You are also flushing the toilet on valuable data into by not doing this as trades are data points and they tell you statistically what the hell is working and what is not, and makes you very aware of what’s going on. Because lets face it, most of you suck at guessing. Hell, I do too. If we were so good at speculating, trading wouldn’t be so damn difficult.

So why guess about your trading statistics by just looking at a PNL, which doesn’t tell you specifics?

I can tell you, tagged trades will often surprise you. Trades you think are good can be subpar, and what you think isn’t so swift crushes it. There’s no way you can keep that data and knowledge in your head. And to that one guy who can – well, I’m not talking to you, so keep that bragging to yourself. We know you’re special and a god and all that, but you are not the majority.

Clarity vs Confusion is one of those trading journal tag combos that really tells you what’s going on. Edge, after all is clarity. A good setup is something you can clearly see in the price action and act on with confidence, because you are clear about what is going on.

Now there is a caveat: A good setup isn’t worth anything if you can’t clearly understand the price action before the trade, during the trade, and after the trade. If you see a trade, but you’re confused about the price action – it will often times not go as planned. You’ll have issues and potentially get blown out. Or maybe lucky.

Price action creates contextual cues; Contextual cues create a narrative; a narrative that you clearly understand leads to good trades. You get more follow through and have less drama.

Now just because you’re clear – doesn’t mean things can’t go sour. It’s trading after all. And trade management will never be perfect.

When you think you’re in a moonshot trade, you can’t whip out your dick and rub one out while holding with the occasional glance up at that charts: You need to pay attention. You need to be clear about the follow through on the trade. Because context shifts, expected value shifts. Pocket aces maybe a great starting hand, however as the game wears on and the other players are betting more, and you don’t have anything else going on, well, you might be in trouble. So you may want to lock it in.

What I’m trying to say is – you better maintain clarity when in the trade. Because if you get confused after the trade has been initiated, then that’s bad. The trade may come back. And hell, the way the market ebbs and flows these days – it’s common place.

Edge is brief moments of clarity. Or at least putting on what you deem to be a good trade.

However, the lead up and follow through are just as important. Lack of clarity is a big killer, and I know 5 traders with that same statistic isn’t the highest sample rate. However, nobody else is explaining specifically why traders fail. The echo chamber just keeps echoing. And for most – that’s just fine…

However, we can’t turn a blind eye to 5 traders whom have several hundred trades each, having the same general statistic on clarity vs confusion. There’s a very nuanced reason to it. Lack of clarity is another layer to the big reason of high failure rate.

What you have to understand is in order to even gain price action clarity, you need a lot of experience through many regime shifts.

And you’re going to mess up bad in the beginning.

It’s the path…

It’s the Traders Creed…

However, you need to learn from those screw ups and understand that a trade not tagged is a wasted data point, and a learning lesson. You must also review video footage. If you don’t do all of this, you may have an excuse. But the chances are – you’re probably making excuses for being lazy.

After all. Everyone wants to be a trader until they have to do trader work.

That alone also really contributes to the high failure rate. Stay tuned for more from me as I want to give you tag ideas and statistics around trading that nobody else will. I’m here to solve the greatest mystery to life. And it’s not big foot.